Message from the CFO

Targeting Stable, Sustained Growth and

Enhanced Capital Efficiency Becoming

a Next-Generation Developer

Managing Executive Officer Yutaka Onuma

Review of the Previous Medium-Term Business Plan and Overview of the New Plan

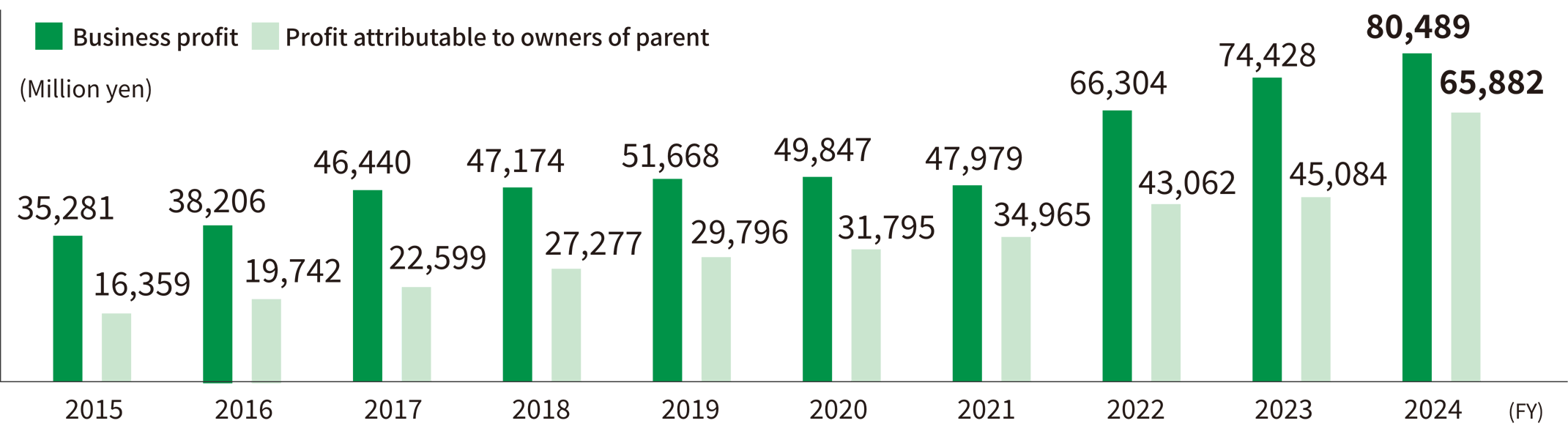

We significantly exceeded our targets for the previous medium-term business plan, which ran through fiscal 2024, ending on December 31, 2024. We achieved our highest ever operating revenue, operating profit, business profit, and ordinary profit, and profit attributable to owners of parent increased for the ninth consecutive year.

Over the five-year term of the previous medium-term business plan, we experienced the COVID-19 pandemic, increases in the number and intensity of geopolitical risks, and the end of the Bank of Japan's negative interest rate policy. In addition, there was a sharp increase in construction costs due to rising material prices and labor shortages. Nonetheless, we successfully deployed our strong product planning capabilities and solid market insights, capitalizing on favorable conditions in the real estate market to achieve our targets for earnings, capital efficiency, finances and all other KPIs. At the same time, challenges remain in particular businesses. Rising construction costs delayed large-scale redevelopment projects, and the overseas, fund, and parking businesses fell short of plan due to changes in the external environment.

Business Profit1 and Profit Attributable to Owners of Parent

1. Business profit before the change in definition

Similar to the previous medium-term business plan, the new plan is positioned as a milestone in our journey toward 2030. While several issues remained under the previous medium-term business plan, solid performance laid the groundwork for further growth toward 2030. Under the new plan, our basic policy is "Building a robust portfolio that is resilient to changes for accelerated growth and greater capital efficiency." We intend to achieve our operating profit target of 95 billion yen by leveraging our strong business portfolio to capitalize on Japan's active real estate market and rising rents resulting from inflation. Furthermore, under the new plan we have set a target of 10% for ROE, which we will achieve by growing earnings while enhancing capital efficiency. Amid increasing uncertainty, we are steadily implementing our strategies to achieve the goals set out in our new medium-term business plan and long-term vision.

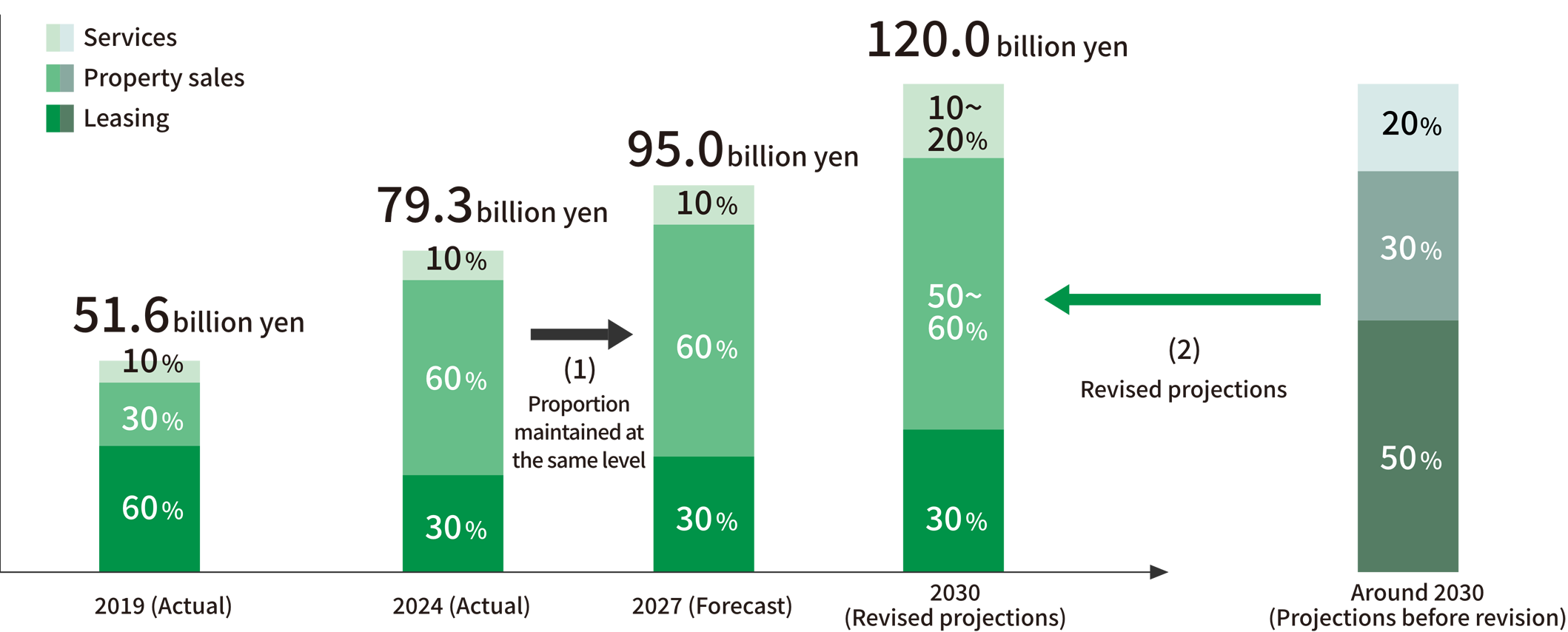

Building a Robust Business Portfolio That Is Resilient to Change

We manage our diverse businesses under the three categories of Leasing, Property Sales, and Services, based on the distinct characteristics of each. Under the new medium-term business plan, we intend to maintain the proportion of profit from each category at the level of fiscal 2024, the final year of the previous plan, while generating cash for growth investments and increasing capital efficiency. We have revised our targets for profit by category in our long-term vision for 2030, increasing the proportion of property sales and reducing that for leasing. This reflects factors such as delays in some large-scale redevelopment projects caused by rising construction costs and longer project timelines, a robust real estate market, and the continued accumulation of high-quality assets in our portfolio.

Projected Shift in Business Profit by Category2

2. Business profit before the change in definition

During the new medium-term business plan period, we intend to pursue a range of initiatives designed to shape the kind of business portfolio Tokyo Tatemono will need to achieve sustainable growth through 2030 and beyond. First, in leasing, we will focus on steady promotion of large-scale redevelopment projects to strengthen the stable revenue base. We will also capitalize on inflationary trends to expand stable earnings by increasing rents for office buildings, which currently account for the majority of our rental asset portfolio. In addition, we will work to enhance risk tolerance and increase yields on our rental asset portfolio by diversifying long-term holdings beyond office properties to include asset types such as hotels, logistics properties, and rental condominiums.

Property sales are crucial for achieving our long-term vision. Conditions in Japan's for-sale condominium market and real estate trading market are favorable. We therefore intend to steadily achieve the earnings targets for property sales in the new medium-term business plan by appropriately selling inventory accumulated during the previous medium-term business plan. Moreover, a key issue during the new plan will be how to effectively invest for growth in 2028 and beyond. To that end, we will place even greater focus on our overseas business in addition to the for-sale condominium business and property sales to investors. Furthermore, as property sales will continue to account for a significant share of earnings and are strongly dependent on the real estate trading market, managing profit volatility will be essential. The Risk Management Committee should prove effective in managing this volatility. Tokyo Tatemono has identified the risk of fluctuations in real estate prices as a priority risk to be addressed, and is building a Group-wide risk management structure that includes monitoring early indicators of market shifts. To detect signs of change in the business environment, we need to get information from the front line as quickly as possible. We will strengthen our risk management framework by using a system that fully leverages our smooth internal communication channels-an area where the Company excels-to quickly detect signs of risk.

The new medium-term business plan divides services into real estate management and experience-based facility operation. We will work to strengthen these two areas over the long term. We recognize that expanding our brokerage business will be particularly important for growth. Addressing corporate real estate needs is one of Tokyo Tatemono's strengths, and during the previous medium-term business plan period, we enhanced our capabilities in this area, enabling us to acquire new customers and deepen relationships with existing ones. We plan to build on this foundation to further expand our brokerage business. We also expect continued growth in our fund business. In addition to property sales to investors, we will actively sell non-current assets to the Group's REITs and funds as a means of expanding Group assets under management (AUM). We will continue to target stable, sustained growth by building a robust portfolio that is resilient to change for accelerated growth and greater capital efficiency.

Balance Sheet Control for Financial Soundness and Growth

We are executing multiple large-scale redevelopment projects in parallel, while also proactively increasing investments in our asset turnover businesses for further growth. All of the initiatives under the new medium-term business plan are strategic steps toward further growth. While growth will necessarily involve a certain degree of balance sheet expansion, we will maintain a sound financial position through disciplined balance sheet control in line with the financial guidelines established under the previous plan-namely a debt-to-equity ratio of approximately 2.4 times and an interest-bearing debt/EBITDA multiple of approximately 12 times.

Furthermore, it goes without saying that we will remain committed to improving capital efficiency even during a period of balance sheet expansion. We have therefore set a goal of selling non-current assets and cross-shareholdings totaling 130 billion yen or more on a sales price basis over the course of the new plan. Through these initiatives, we aim to maintain and improve capital efficiency while also securing the funds needed for growth investments.

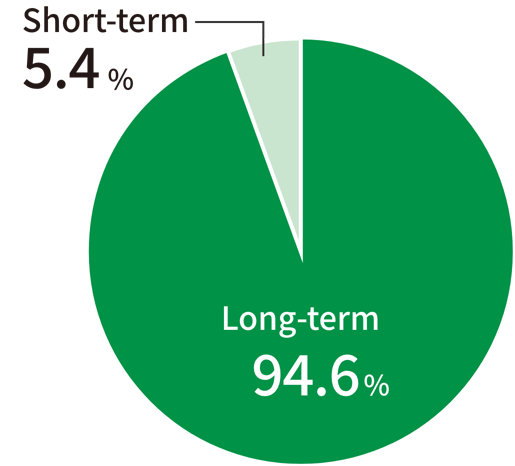

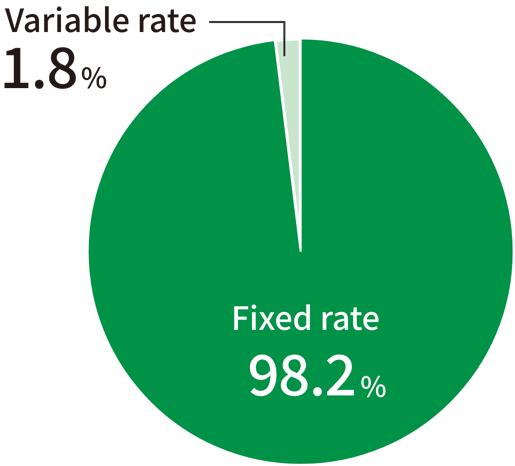

With regard to financing, we will staunchly adhere to our financial guidelines in procuring funds, primarily through borrowing. Following the Bank of Japan's policy change in March 2024, interest rates in Japan have been trending upward and are once again a material factor. The impact of rising interest rates on our borrowings and business operations is currently limited, but we must continue to closely monitor future developments. To mitigate risk, we will use typical hedges such as extending borrowing maturities and locking in interest rates, while also working to maintain and improve our credit ratings with major rating agencies.

Long-Term vs.

Short-Term Borrowings(As of December 31, 2024)

Average remaining maturity:3 6.1 years

Fixed-Rate vs. Variable-Rate Borrowings(As of December 31, 2024)

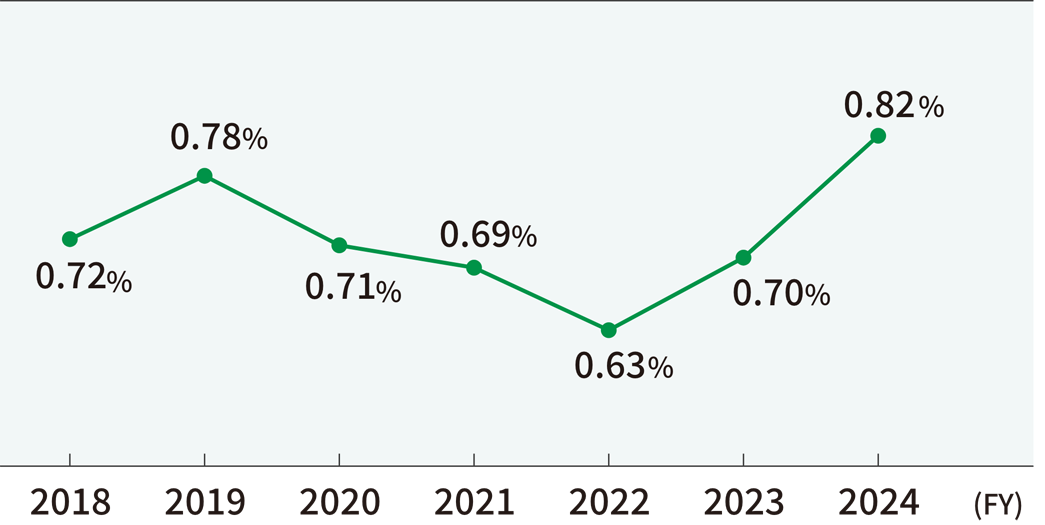

Average Interest Rate4

3. Excluding hybrid corporate bonds and commercial paper

4. Average interest rate = Interest expenses ÷ Average balance of interest-bearing debt at beginning and end of year

In May 2025, Japan Credit Rating Agency (JCR) affirmed our A rating and upgraded our outlook to Positive from Stable, in recognition of our track record of sustained profit growth and the expected enhancement of stable earnings sources when TOFROM YAESU becomes operational. We will continue to consider our optimal capital structure as circumstances evolve, taking various perspectives into account, with the aim of achieving sustainable profit growth and higher capital efficiency.

A Cash Allocation Plan Designed to Accelerate Asset Turnover for Higher Capital Efficiency and Increase Shareholder Returns through Sustainable Profit Growth

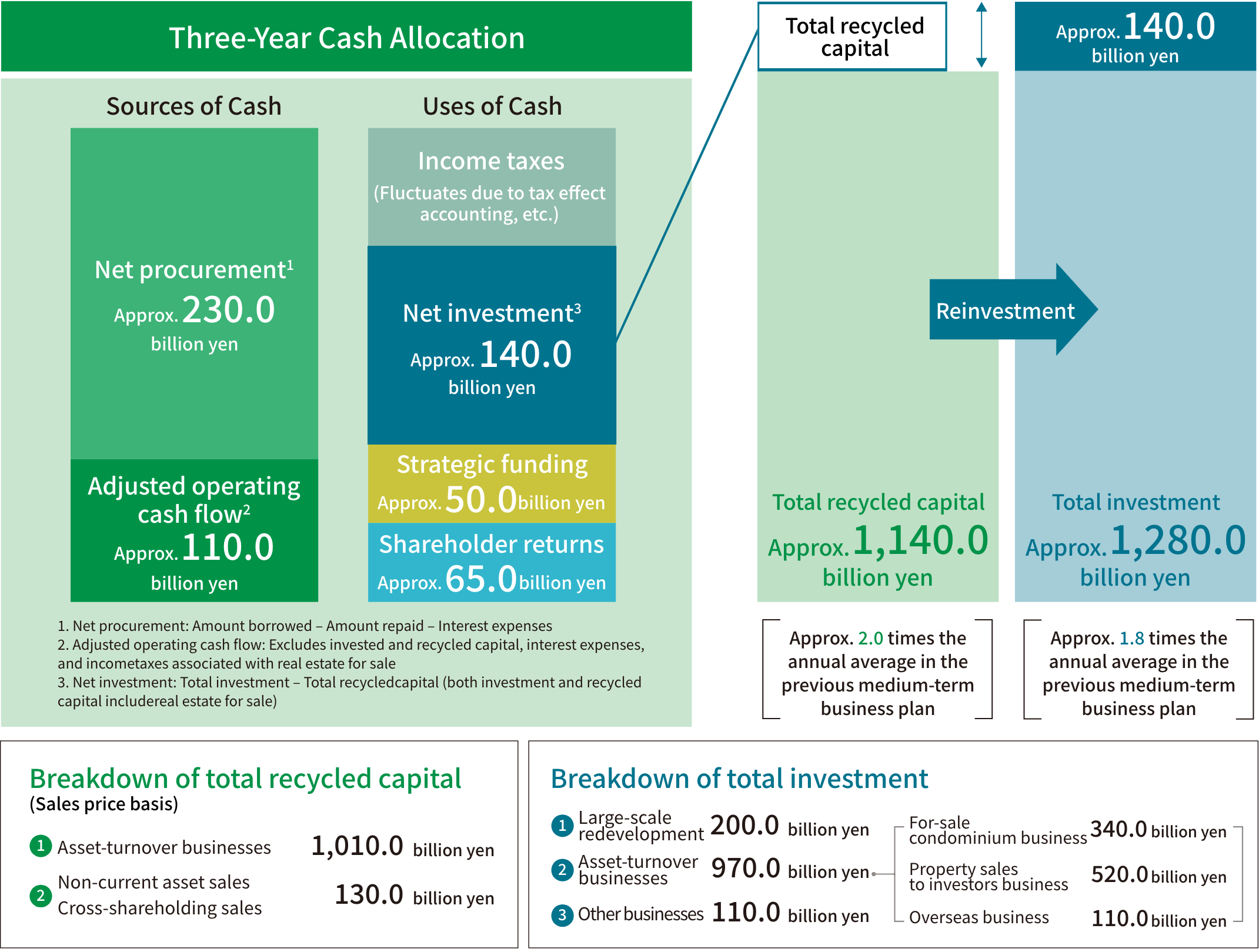

Our basic policy for cash allocation under the new medium-term business plan is to accelerate asset turnover for higher capital efficiency and increase shareholder returns through sustainable profit growth. For the first time, Tokyo Tatemono has addressed investor interest by presenting a clear and effective overview of cash inflows and outflows in its medium-term business plan.

During the new plan period, we expect to generate 1,140.0 billion yen primarily from capital recycling, which is 2.0 times the annual average we anticipated in the previous plan. We also expect to invest a total of 1,280.0 billion yen, which is 1.8 times the annual average we anticipated in the previous medium-term business plan. Steady capital recycling and reinvestment are crucial for the Group's sustainable growth, and we have strong confidence in the success of our recycling strategy. During the previous medium-term business plan period, favorable conditions in the real estate transaction market enabled us to build a diverse inventory of properties for sale to investors, as well as other high-quality assets that are responsive to changes in the market environment. While there are concerns about rising interest rates and changes in the business environment, we will steadily execute our plan by selling high-demand real estate as market conditions evolve.

Furthermore, our planned total investment of 1,280.0 billion yen, when averaged annually, is roughly on par with the investment level in fiscal 2024, the final year of the previous medium-term business plan. We are confident we can achieve this target by leveraging our track record and the know-how we gained during the previous plan. A key factor in doing so will be our ability to obtain high-quality information through the relationships we have built with various business partners. Rather than engaging in price competition with peers, we have consistently and efficiently secured land through a unique acquisition strategy centered on negotiated transactions. In addition, our organizational structure enables us to seamlessly handle every asset type, contributing to our strong product planning capabilities. Building on these strengths, we will accelerate investment by pursuing selective opportunities while maintaining price competitiveness.

Another first in the new medium-term business plan is strategic funding that is not designated for specific purposes. We intend to flexibly deploy this strategic funding, totaling 50 billion yen over three years, in executing strategic developments, including new businesses and M&A. While remaining mindful of maintaining an optimal capital structure in light of evolving business conditions and other factors, we will take a flexible approach to reviewing the use and allocation of funds. We have positioned both total investment and strategic funding as capital for investments during the new medium-term management plan period and beyond. By steadily building a track record of results, we intend to translate these investments into sustainable growth.

Finally, we are committed to further enhancing shareholder returns, and have therefore decided to increase our dividend payout ratio to 40% by fiscal 2027, while maintaining a balanced approach with growth investment. In addition, while we position dividends as the primary component of shareholder returns, we also intend to flexibly conduct share buybacks, taking into account factors such as our share price, business environment, and financial position. Since fiscal 2013, we have increased dividends for more than 10 consecutive fiscal years and we aim to continue doing so through sustainable profit growth.

Our Commitment to Corporate Value and Stakeholders

My conversations with investors since becoming CFO in 2025 have given me a renewed insight into how markets evaluate the Tokyo Tatemono Group, the challenges we face, and the issues that matter most to investors. My primary mission is to steadily achieve the targets of the new medium-term business plan and maximize our corporate value. I believe Tokyo Tatemono's shares are still undervalued, likely because we have not made investors fully aware of our growth potential and earnings stability.

To foster stronger expectations for continued growth, I see dialogue with investors as key. We will use appropriate disclosure and dialogue to deepen understanding of the Group and demonstrate, through our track record and strategies, the high likelihood of growth in earnings and shareholder returns. To further reinforce long-term earnings stability, the new medium-term business plan positions sustainability, human capital, and digital transformation as core management infrastructure supporting growth and serving as the foundation of the basic policy. By incorporating the opinions and suggestions gained through investor dialogue into our management practices, we aim to further enhance the quality of our disclosure and engagement, thereby fostering greater confidence in our long-term growth potential.

Coinciding with the launch of the new medium-term business plan, Tokyo Tatemono has revitalized its management team, including the appointment of a new President and Chief Executive Officer. One of our core strengths is the openness among management team members, which is reflected in the lively exchange of opinions at management meetings and other forums-a distinctive feature of the Group. Under the new management structure, we are committed to consistently delivering solid results and enhancing corporate value. We will devote our efforts to deepening understanding, building investor trust, and increasing corporate value through a range of initiatives, including the successful implementation of the new medium-term business plan, outlining a clear path toward our long-term vision for 2030, and enhancing both disclosure and dialogue.