Environment

KPIs and Targets

Environmental Management

Related Material Issues

-

Contributing to a safe and secure society

-

Wellbeing

-

Addressing the diverse needs of customers and society

-

Social implementation of technology

-

Promoting a decarbonized society

-

Promoting a recycling-oriented society

Policy and Concept

Under the Tokyo Tatemono Group Environmental Policy, we contribute to the development of a sustainable society through environmentally conscious business activities. We have identified promoting both a decarbonized society and a recycling-oriented society as environmental material issues and, by working to resolve these issues through our business, aim to realize coexistence with the earth and the environment, a value we share with society.

Group Environmental Policy

We will help build a sustainable society through environmentally-friendly business activities based on the following Group Environmental Policy.

-

Creating a pleasant city and life with greenery

We will create a rich and comfortable environment for Earth and people by utilizing the strength of greenery as much as possible with consideration to biodiversity.

-

Climate change prevention that leads the community

We will actively implement environmentally friendly technologies and ideas into our products and services to lead the community in building a low-carbon city.

-

Resource-saving activities that are kind to the Earth

We will strive to reduce the use of resources and environmental impact through all available opportunities and contribute to creating a recycling-oriented society.

-

Developing employees with high environmental awareness

We will comply with laws related to the environment and educate and raise the awareness of our employees about the environment.

Established January 2011

Environmental Management Framework

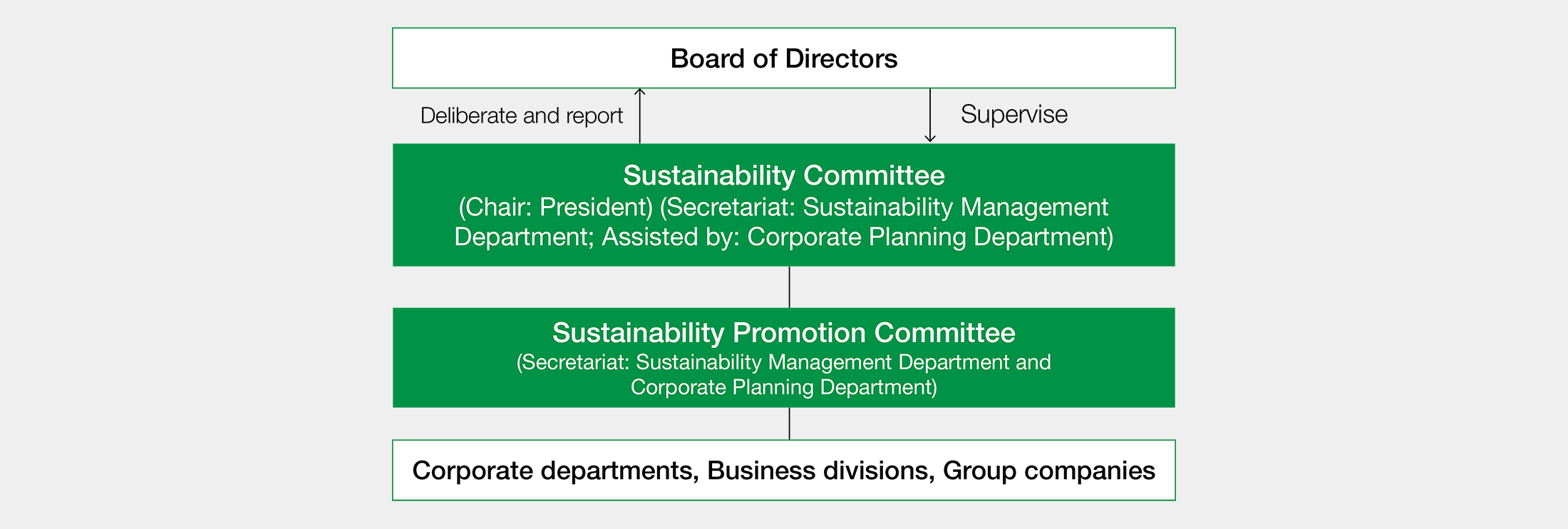

The Tokyo Tatemono Group promotes environmental measures across the entire Group under the Sustainability Committee, chaired by our president, and the Sustainability Promotion Committee, a subordinate organization of the Sustainability Committee.

We have also established environmental management systems aligned with the characteristics of each of our businesses. Our PDCA cycle was built based on these systems, enabling us to formulate environmental measures, share information, support implementation, provide guidance, manage progress, and carry out improvements to initiatives.

Environmental Management Framework Chart

Actions

Promoting a Decarbonized Society

Related Material Issues

-

Addressing the diverse needs of customers and society

-

Social implementation of technology

-

Promoting a decarbonized society

Policy and Concept

Realizing a decarbonized society is a social issue that calls for global solutions. The real estate industry must also strive to reduce greenhouse gas (GHG) emissions derived from real estate holdings and business activities. The Tokyo Tatemono Group further believes that the intensification of storms, flooding, and other natural disasters owing to GHG emissions could have a significant impact on the assets it owns. From this perspective as well, we recognize the need to prioritize this issue.

The Tokyo Tatemono Group Environmental Policy calls for us to lead the community in the prevention of global warming. In addition, we have identified the promotion of a decarbonized society as a material issue, and in order to address this issue through our business, we have set KPIs and targets related to the promotion of a decarbonized society. We are also accelerating our efforts to reduce GHG emissions, etc.

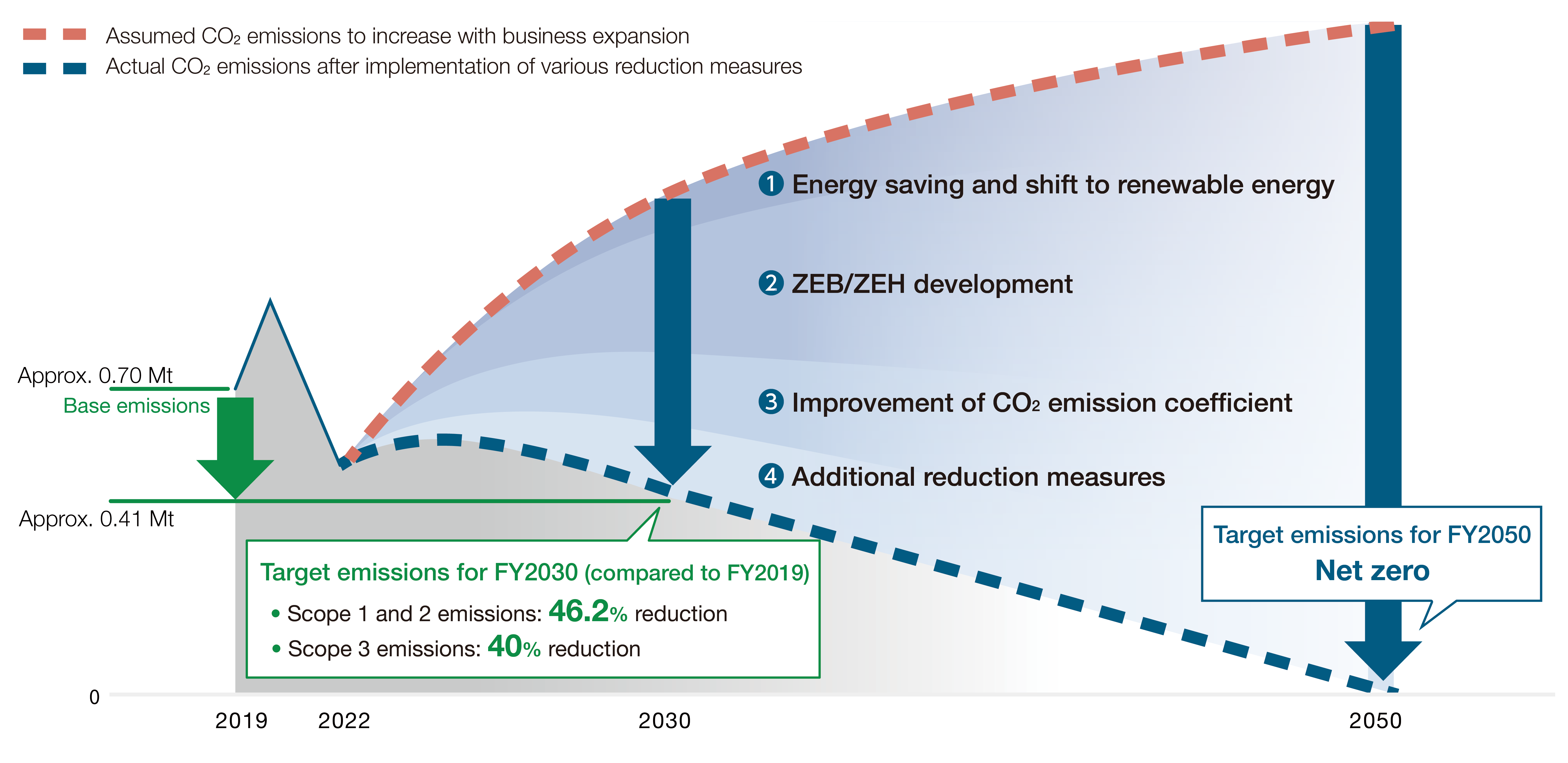

In October 2023, we raised our target for GHG emission reductions by FY2030 to the 1.5°C level. Based on these assumptions, we put in place a roadmap (action plan) for reducing GHG emissions in the Group toward FY2050.

Roadmap for Reducing GHG Emissions

Actions

Responding to Natural Disasters

Related Material Issues

-

Strengthening Tokyo's competitiveness as an international city

-

Contributing to a safe and secure society

-

Community building and revitalization

-

Wellbeing

-

Social implementation of technology

-

Promoting a decarbonized society

Policy and Concept

Natural disasters such as major earthquakes and typhoons threaten our way of life. Climate change has resulted in frequent destructive typhoons and extreme weather in recent years. As a result, interest is rising faster than ever in the safety of real estate, which is a foundation of our lives.

The Tokyo Tatemono Group believes that improving resilience against disasters in ordinary times and providing safety and security to our customers and other stakeholders are important responsibilities.

We have identified contributing to a safe and secure society as a material issue for the Group. To address this issue through our business operations, we will continue to further strengthen our measures against natural disasters.

Actions

Biodiversity

Related Material Issues

-

Promoting a decarbonized society

-

Promoting a recycling-oriented society

Policy and Concept

The Tokyo Tatemono Group is working toward a vision of creating a pleasant city and life with greenery, a commitment that is included in our Group Environmental Policy. As real estate development is closely tied to the natural environment and local ecosystems, we strive to understand the direct and indirect impacts it may have and take appropriate measures in response. We are striving to create a rich and comfortable environment that takes biodiversity into consideration, and our efforts include maximizing the power of greenery by transplanting trees on our properties in line with their development plans, surveying local vegetation and the distribution of organisms, and selecting tree species to plant.

We have established environmental guidelines for both our Commercial Properties Business and Residential Business. Both sets of guidelines establish policies for greening buildings and sites, using greening to mitigate the heat island effect, preserving biodiversity and ecosystems including links to the surrounding greenery, and using greenery for communication with tenants and residents as well as the surrounding area. In addition, we have acquired third-party certifications for the preservation of existing trees and the conservation of ecosystems such as ABINC Certification*1 and SEGES*2 for our properties that are capable of implementing initiatives of a certain scale.

-

A system for evaluating and certifying biodiversity conservation efforts in the use of land for office buildings and residential buildings. It is based on two evaluation standards, the Association for Business Innovation in harmony with Nature and Community® Certification Guideline and the Land Use Score Card®, both developed by the Japan Business Initiative for Biodiversity (JBIB).

-

Social and Environmental Green Evaluation System. An evaluation system for green spaces that contribute to society and the environment by Organization for Landscape and Urban Green Infrastructure, which visualizes the social and environmental value of green spaces.

Actions

Water Resources

Related Material Issues

-

Contributing to a safe and secure society

-

Promoting a recycling-oriented society

Policy and Concept

As water shortages become even more severe worldwide, developed nations and the rest of the world face demands to continuously improve the efficiency of water use.

The Tokyo Tatemono Group Environmental Policy includes a call for resource-saving activities that are kind to the Earth. We have also identified "Promoting a Recycling-Oriented Society" as one of our material issues. To address this challenge through our business activities, we have established KPIs and targets related to water resources. We work to conserve water resources by reducing environmental impact and engaging in resource-saving activities such as water conservation and the reuse of rainwater and miscellaneous wastewater (gray water) whenever possible.

Actions

Promoting a Recycling-oriented Society

Related Material Issues

-

Contributing to a safe and secure society

-

Promoting a decarbonized society

-

Promoting a recycling-oriented society

Policy and Concept

Pollution of the air, soil, and water caused by waste and hazardous substances and the depletion of natural resources are issues shared by all of society. Businesses have an obligation to reduce the waste and hazardous substances generated by their activities and use natural resources effectively.

The Tokyo Tatemono Group Environmental Policy includes a call for resource-saving activities that are kind to the Earth. In addition, we have identified Promoting a Recycling-oriented Society as one of our material issues, and have also established KPIs and targets related to waste in order to address the resolution of this issue through our business activities. We are striving to reduce our environmental impact through our businesses and contribute to creating a recycling-oriented society. In the development of buildings, we incorporate life-cycle assessments into project concepts and designs, and in operations and management, we work to reduce waste and minimize the generation of hazardous substances through proper practices.

Actions

External Evaluation and Certification for Green Building

Related Material Issues

-

Strengthening Tokyo's competitiveness as an international city

-

Addressing the diverse needs of customers and society

-

Revitalizing and utilizing real estate stock

-

Promoting a decarbonized society

Policy and Concept

The Tokyo Tatemono Group recognizes that, to meet the expectations and demands of our tenants, investors, and other stakeholders, it is essential that we develop and operate real estate while taking into consideration the reduction of our environmental impact as well as the comfort and diversity of our users. It is also key that we provide open disclosure of our performance and initiatives related to such real estate.

The Tokyo Tatemono Group has identified the promotion of a decarbonized society as one of its material issues, and has established KPIs and targets for promoting the development of ZEB and ZEH as well as acquiring green building certifications in order to address this issue through its business activities. In addition to new buildings, we are actively obtaining external green building evaluations and certifications for our existing office buildings and for-rent condominiums.

Actions

Sustainability Finance

Related Material Issues

-

Strengthening Tokyo's competitiveness as an international city

-

Contributing to a safe and secure society

-

Community building and revitalization

-

Addressing the diverse needs of customers and society

-

Value co-creation and innovation

-

Promoting a decarbonized society

Policy and Concept

Sustainability finance refers to bonds and loans to raise funds specifically for the purpose of promoting sustainability by addressing environmental issues such as climate change or social issues such as poverty, health, and economic disparity.

The Tokyo Tatemono Group promotes urban development that contributes to solving social issues. We strive to improve the attractiveness of the areas in which we develop and to increase the value of our entire asset portfolio. We aim to channel these efforts toward our sustainable growth as a company.

We will accelerate the cycle of allocating the funds we raise to projects that help bring about a sustainable society. We will help promote a decarbonized, sustainable society by balancing, at a high level across our operations, the need to address social issues with the need for business growth.

Sustainability Finance Framework

Tokyo Tatemono has put in place several finance frameworks to guide its financing. These frameworks apply the four requirements defined in the Green Bond Principles, Social Bond Principles, Green Loan Principles, and Social Loan Principles referred to by the International Capital Markets Association: Use of Proceeds, Process for Project Evaluation and Selection, Management of Proceeds, and Reporting.

Use of Proceeds

Proceeds will be allocated to projects that meet eligibility criteria such as the acquisition or construction of green buildings and social projects addressing social problems, or will be used for refinancing such projects.

Process for Project Evaluation and Selection

The Finance and Sustainability Management Departments select projects that meet the eligibility criteria. The final decision is made by the President or the Chief Financial Officer.

Management of Proceeds

The status of the allocation of proceeds is tracked and managed by the Finance Department using an internal control system. The results are confirmed by the officer in charge of the Finance Department or the general manager of the Finance Department on a quarterly basis. The proceeds are managed as cash or cash equivalents until they are allocated. For unallocated proceeds, should they arise, projects will be selected from among projects that meet the eligibility criteria. The unallocated proceeds will be managed in cash or cash equivalents until their reallocation is decided.

Reporting

We disclose the allocation status of proceeds, environmental improvement impacts, and social benefits on our website once yearly until all proceeds classified for allocation reporting are fully allocated.