The Chronicles of TOKYO TATEMONO

This is an overview of the over-125-year history of Tokyo Tatemono’s urban development.

1896 - 1920

A pioneer of modern real estate

1921 - 1945

From Great Kanto earthquake restoration to the end of WWII

1946 - 1978

Rebuilding from scorched earth and becoming a general real estate company

1979 - 1995

From an era of enlargement and differentiation to management in a post-bubble economy

1996 - 2005

New management development in a new century

2006 - 2019

Urban development that leads to the creation of added value in the future

2020 - Today

Becoming a Next-Generation Developer

1896 - 1920 A pioneer of modern real estate

-

1.The Establishment of Tokyo Tatemono Co., Ltd.

-

2.Installment-based Construction Contracting as Its Main Business

-

3.Overseas Expansion to Overcome Poor Performance

The Establishment of Tokyo Tatemono Co., Ltd.

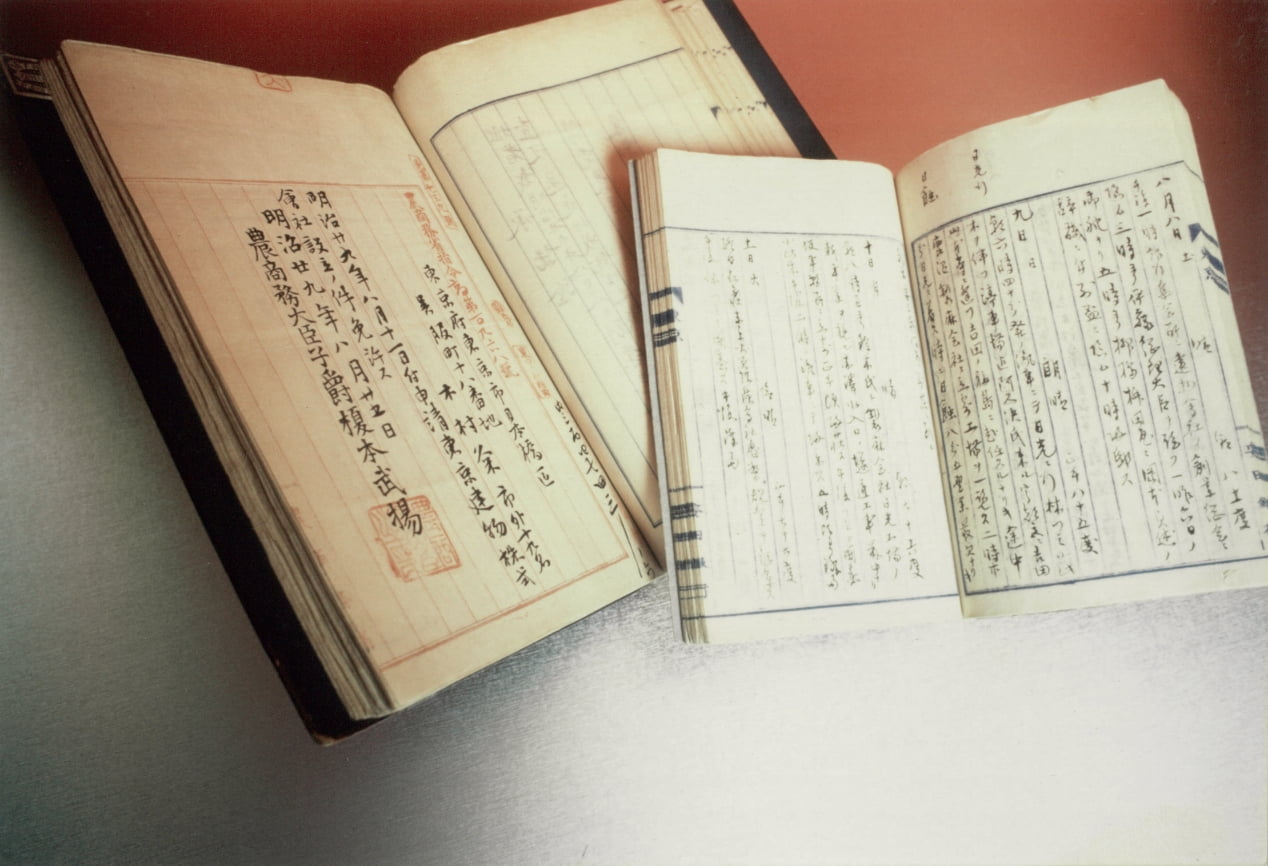

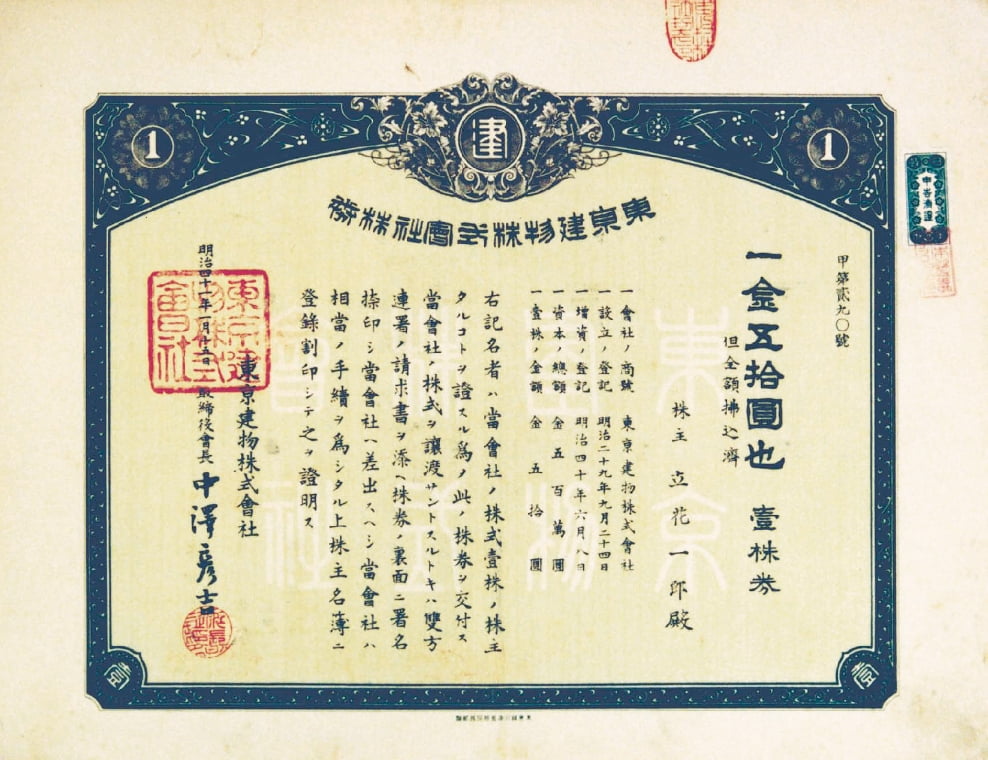

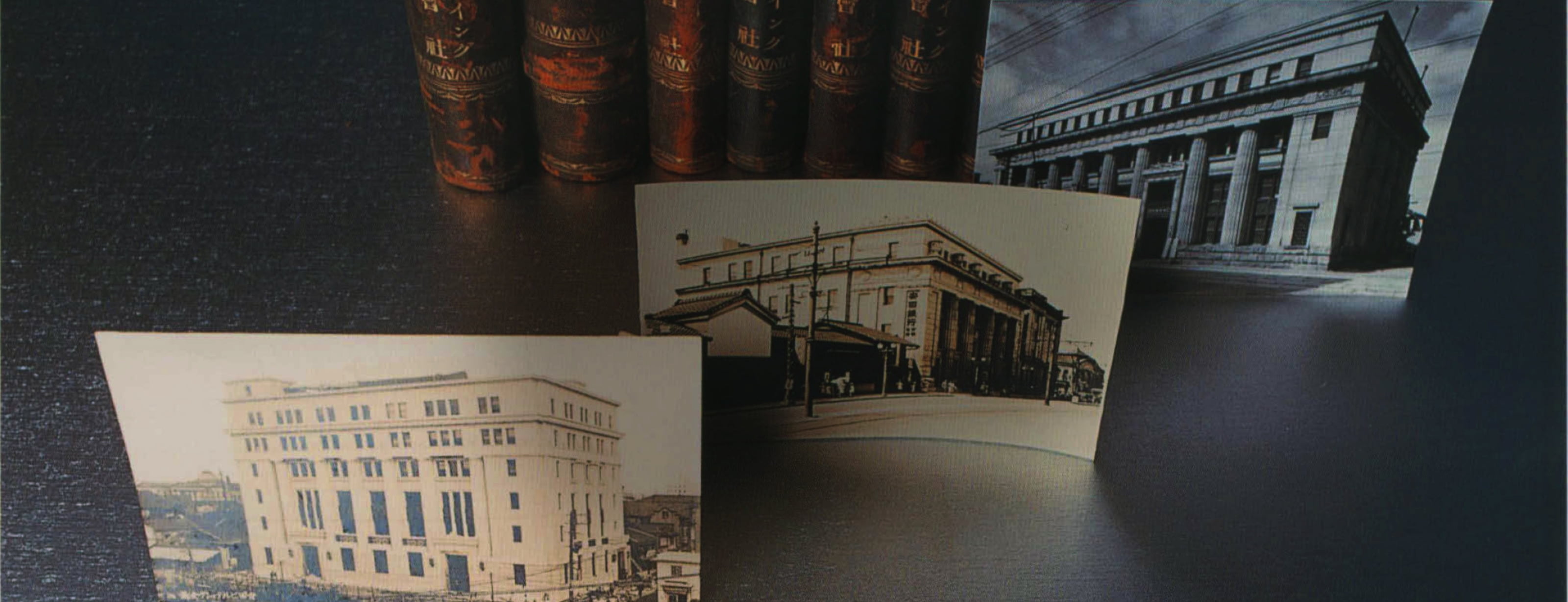

Tokyo Tatemono Co., Ltd. was established in October 1896 in Gofuku-cho, Nihonbashi Ward, Tokyo by Zenjiro Yasuda, the founder of the Yasuda Conglomerate, one of four major conglomerates in Japan at the time. This marked the birth of Japan's first modern real estate company.

At around the turn of the 20th century, Japan, victorious in the Sino-Japanese War, experienced an unprecedented economic boom, with infrastructure improvements in roads and waterworks, and other construction projects. However, the infrastructure for real estate transactions had not yet been developed, and fraudulent transactions were rampant, hindering normal economic development.

In response to these conditions, Zenjiro Yasuda, who had extensive experience in valuable real estate transactions through Yasuda Bank (current Mizuho Bank), which he had founded, decided that a financial institution specializing in land and buildings was necessary. He sought cooperation from major business figures in Tokyo at the time in establishing a new company, and obtained consent from many influential people to become promoters and investors.

At a time when Tokyo was forming as a city, Zenjiro's concept of a financial institution specializing in land and buildings gained the support and expectations of the financial and business worlds due to its high public nature and public interest, and this led to the establishment of Tokyo Tatemono. This was the first step in developing the real estate business, which until then had been a private business, into a modern industry.

Installment-based Construction Contracting as Its Main Business

At the time of the founding of Tokyo Tatemono, its main business was loan-based construction contracting, and it also provided real estate collateral loans and served as a broker for real estate sales.

Loan-based construction contracting is the undertaking of all aspects of construction of residences, offices, stores, plants, and other facilities from design to construction, based on customer desires, with the ownership of the land and building transferred to the customer with monthly installments over a period up to 15 years. In principle, it led the way for the first installment sales, and Tokyo Tatemono is said to have created the prototype for mortgage loans in Japan.

After the Company opened its doors, applications for real estate collateral loans flooded in, and business was so successful it had to temporarily halt accepting applications less than a year after operations started.

These projects responded to the strong demand for construction and finance, and Zenjiro's excellent foresight and outstanding conceptual ability were apparent.

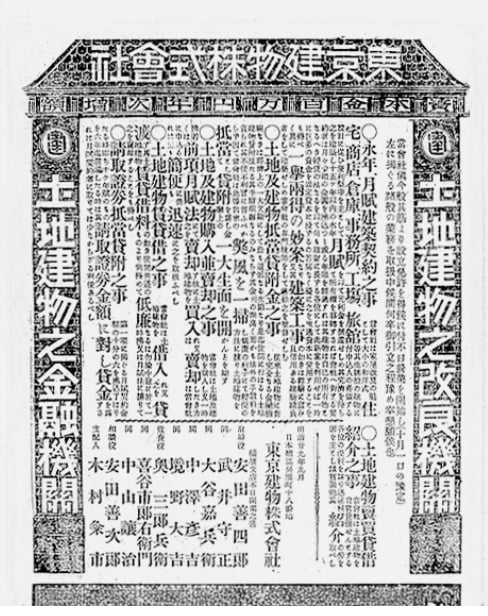

An advertisement announcing the establishment of Tokyo Tatemono included the following text:

"To improve the land and buildings and ensure practical use of financial institutions,...we want comfort in private residences and, at the same time, seek to elevate the dignity of the imperial capital."

This founding decision to want to improve the lives of each and every citizen and develop Tokyo as a whole shows the high aspirations of Zenjiro and continues to this day as our corporate mission.

Overseas Expansion to Overcome Poor Performance

Management remained steady immediately after the Company's founding, but in 1901, the capital was affected by post-Sino-Japanese War recession and financial depression, and the Company's performance began to slow.

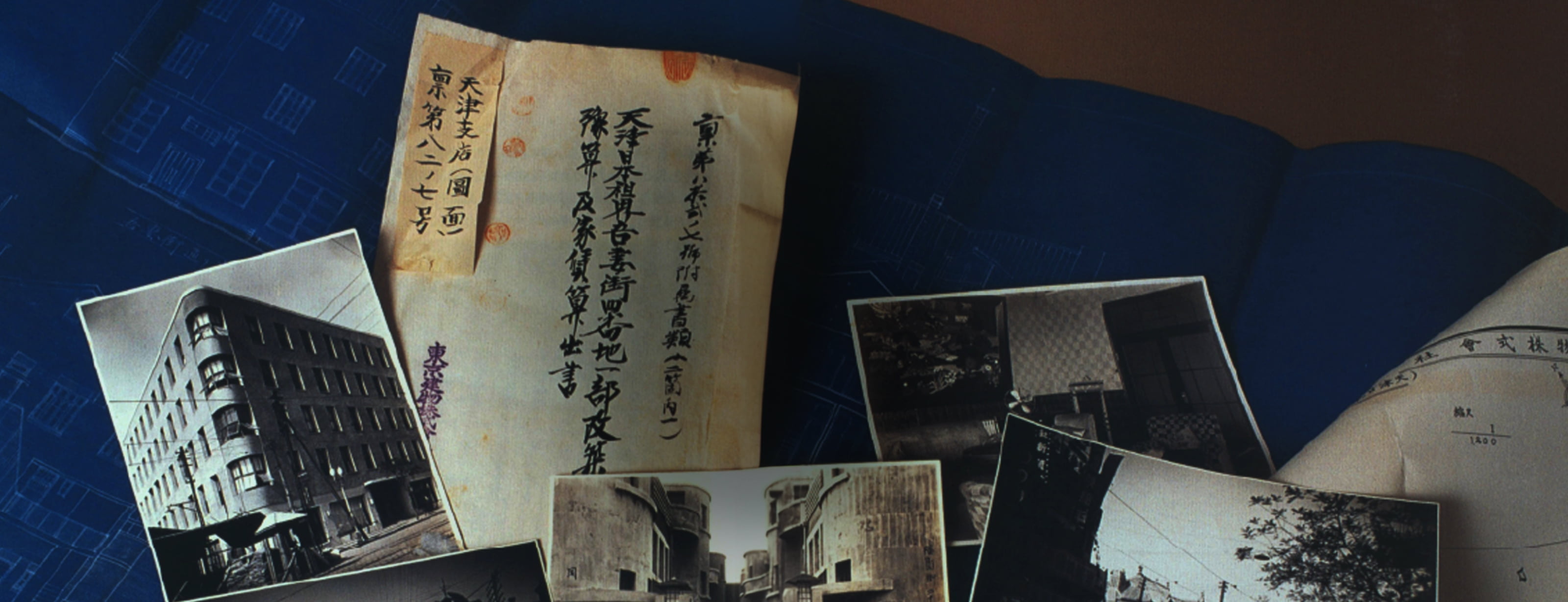

The solution to that poor performance was overseas expansion. After receiving a grant from the Ministry of Foreign Affairs for approximately 31 acres under Japanese concessions in Tianjin, China, the Company opened the Tianjin Branch in 1903 and began construction, management, and operation of residences and office buildings.

In 1907, the Company took over the business of the Tianjin enterprise group and operated the electric power supply within the Tianjin concession, further strengthening the management base. The performance of the Tianjin Branch greatly contributed to the overall earnings of the Company until the branch was closed at the end of WWII in 1945.

Expanding to Tianjin was the result of the Katsura Cabinet approaching the Company about developing and managing the Japanese concession. The business opportunity to expand overseas was possible due to Tokyo Tatemono being a leading full-fledged real estate company and the tremendous trust that the political and business world had in the management skills of Zenjiro.

The Company continued to expand overseas, and in 1907, it began to manage concession land after receiving the sale of land within the Japanese concession of Hankou (current Wuhan), and it opened a branch office there in 1919. In August 1910, the Company expanded to Gyeongseong (current Seoul, South Korea). In 1917, the subsidiary Manchuria Kogyo was established in Manchuria, China and began operations.

1921 - 1945 From Great Kanto earthquake restoration to the end of WWII

-

1.Great Kanto Earthquake Restoration and Business Development During the Showa Depression

-

2.Activities at Overseas Branches and Offices

-

3.Business Activities in a Controlled Economy and Response to the Wartime Regime

Great Kanto Earthquake Restoration and Business Development During the Showa Depression

On September 1, 1923, the Great Kanto Earthquake struck Eastern Japan, causing extensive damage to the region and the Company. The president at the time was lost in the disaster, and the head office building just completed in Gofuku-cho, Nihonbashi Ward of Tokyo in 1917 also suffered damage. Due to spreading fire, the inside was burned down, destroying most of the Company's documents. The Yokohama Branch also burned down. In total, approximately 85 buildings and over two acres of land owned by the Company were destroyed by fire as well as many buildings used as collateral. A decrease in rental income and inability to collect loans led to a significant decrease in revenue, but the losses were written off with carryforwards and insurance funds, helping overcome the crisis.

After the earthquake, people sought homes in western Tokyo and its suburbs, which were relatively undamaged, and efforts to urbanize Tokyo gained momentum. Amid this trend, the Company entered the land and building sales business. Leading the way were the sales of lots at Sekiguchi-daimachi in Koishikawa Ward of Tokyo and lots at Sendagaya-onden in Sendagaya-cho, Toyotama-gun in 1928. Business was expanded to the development and sale of villa land, and the Company began sale of villas with hot springs in Yugawara-machi, Kanagawa.

The mid-1920s marked the start of the Company's "building era." In 1929, construction was started on the Tokyo Tatemono Building, a head office building with a full-fledged earthquake- and fire-resistant construction, in front of the East Exit of Tokyo Station (current Yaesu Central Exit). Although Japan was in a recession following the financial crisis, because of the location of the head office building, demand for rented offices was stronger than expected. In 1943, the Company merged with Yasuda Building Co., Ltd., giving Tokyo Tatemono ownership of Osaka Building, Kyoto Building, and Fukuoka Building.

Activities at Overseas Branches and Offices

Japan in the early 1930s faced a serious recession known as the Showa Depression due to the austerity policy of the Hamaguchi Cabinet and the Great Depression that started in 1929. At that time, the Company was committed to solid management that included careful selection of lenders and restrictions on monthly construction orders in Japan. Meanwhile, overseas business was performing well.

Activities at the Tianjin Branch, in particular, were remarkable, with the office starting renovation plans for large-scale owned buildings in response to strong demand for housing with the increase in the number of Japanese residents in the Japan concession. Fulfilling its duties as the only real estate company in the concession, Tokyo Tatemono came to own over 24 acres of land with buildings and most of the prime land in the concession in the mid-1930s. In addition, after the outbreak of the Second Sino-Japanese War, the Company was commissioned by the Japanese military to construct military quarters and manage various real estate in occupied territories.

In Manchuria, after the Company merged with Manchuria Kogyo in 1937, the commercial rights were taken over by Kangde Real Estate, a local subsidiary. Kangde Real Estate was mainly engaged in leasing operations in Anshan, an industrial city, Shenyang, an economic city, and Dalian, the location of the head office of the South Manchurian Railway. With the increase of Japanese in Manchuria and amid the development of Manchukuo and the military economy, the Company generated steady revenue.

The Gyeongseong Branch steadily increased its transaction volume by focusing on monthly installment loans and secured loans. In the mid-1930s, the Company showed dramatic development due to sales of large-scale pre-built housing, construction of rental buildings, and large-scale contract work orders.

Business Activities in a Controlled Economy and Response to the Wartime Regime

In July 1937, the Second Sino-Japanese War began, and the Japanese government tightened economic controls. Tokyo Tatemono was placed under various control ordinances, which directly and indirectly affected its operations, with the Rent Control Act (October 1939) and Price Control Ordinance for Lots and Buildings (November 1940) posing serious problems that affected the very foundations of its management. Furthermore, the Metal Collection Act (August 1941) led to the collection of everything from window bars and stair railings to elevators, significantly damaging the property value of buildings.

With the start of the Pacific War in December 1941, a further response to the wartime regime was required. In some cases, when locations were designated as forced evacuation areas, buildings were forced to be demolished to prevent the spread of fire as a countermeasure to air raids. Several buildings owned by Tokyo Tatemono were among those designated as forced evacuation areas.

After the Battle of Saipan in July 1944, air raids by the U.S. military on mainland Japan increased, and on March 10, 1945, the Tokyo Tatemono Building, which served as the head office, was lost during the bombing of the capital. The air raids also damaged the properties owned by the Company and loan collateral buildings, and by the end of the war, 215 buildings were evacuated or damaged, totaling nearly 34,442 square meters , and resulting in a loss of approximately 30% of the Company's domestic assets.

1946 - 1978 Rebuilding from scorched earth and becoming a general real estate company

-

1.Postwar Business Rebuilding and Overcoming Deficit Management

-

2.Establishing Four Pillars of Business and Expanding to New Business

-

3.Expanding into New Business and Developing Existing Business in the Growing Real Estate Sector

Postwar Business Rebuilding and Overcoming Deficit Management

In August 1945, the Potsdam Declaration was accepted by Japan, ending the war. The defeat in the war led Tokyo Tatemono to lose its foreign assets, which had been the mainstay of its earnings, all at once. This amounted to approximately 40% of all land owned by the Company and roughly 77% of all owned buildings.

Furthermore, the economic democratization policy for postwar Japan introduced by the Supreme Commander for the Allied Powers (SCAP) had a tremendous impact on the Company. The dissolution of conglomerates separated the Company from the Yasuda Conglomerate, the Company was designated as a restricted company, which required approval of the Minister of Finance and SCAP to dispose of assets and borrow funds, and wartime compensation from the Japanese government was terminated.

With the Company on the verge of extinction after the loss of its overseas assets, Tokyo Tatemono had to make a fresh start after the war under severe restrictions on all aspects of its business.

Greatly contributing to the rebuilding of its business were the maintenance work of the Grant Heights U.S. military family housing and the launch of a full-scale construction contracting business. In particular, the construction contracting business saw a demand for postwar reconstruction, and after getting a start with government office construction, the business expanded to include civil engineering projects.

While the Company experienced aggressive business development, it also worked to recover profitability in its main business of building leasing and increase the number of real estate brokerage properties, thereby gradually recovering its business performance. As a result, it wrote off the loss carried forward in the first half of fiscal 1949, and was out of the red in the second half of fiscal 1945. It was relisted on the Tokyo Stock Exchange in May 1949.

Establishing Four Pillars of Business and Expanding to New Business

By 1955, 10 years after the end of the war, Japan's GNP had exceeded prewar levels, and the country had entered a phase transitioning from postwar reconstruction to new growth. Real estate companies were required to respond to growing business opportunities and qualitative changes in demand.

In 1956, the Company decided to exit the construction contracting business. The following year, in 1957, Tokyo Tatemono clearly set its sights on becoming a general real estate company focusing on three pillars of business: real estate sales, real estate leasing, and real estate brokerage and appraisal. In 1960, it expanded its business to residential land development, establishing a structure for business development as a general real estate company in line with a new era.

At this time, industry in Japan experienced a shift from primary industry to secondary and tertiary industries, and the Tokyo metropolitan area experienced an increased concentration of population. As demand for office buildings in urban areas rapidly increased, Tokyo Tatemono focused on expanding its building leasing business. As a first step, in 1958, the Company expanded and remodeled the head office building in Tokyo, and over the next 10 years, it newly constructed and expanded a total of 10 buildings, including Osaka Building, Shinjuku Building, and Yokohama Station West Exit Building. The Company's owned building area expanded from nearly 13,200 square meters in 1956 to nearly 1 million square meters in 1966, an increase of nearly 800% over 10 years.

With the economic expansion, urban areas experienced a serious housing shortage, which became a social problem. The Company expanded the scale of its residential land development business started prior to the war, and it worked to provide quality and reasonably priced residential land and housing. Tokyo Tatemono used its expertise gained in the residential land sale in Izumi-Tamagawa in 1961 and consignment sale of Tsurumi Heights condominiums in 1963, and in that same year, the Company became an owner for the first time in the postwar era and then developed and sold the Nakagawara subdivision in Fuchu, Tokyo. While the Company continued to aggressively sell residential land, it expanded its business to the sale of villa land.

Expanding into New Business and Developing Existing Business in the Growing Real Estate Sector

After the Tokyo 1964 Summer Olympics, Japan experienced the 1965 recession that bottomed out in October 1965, and then the country entered the second half of its high-growth period. During this time, the Company aggressively entered the condominium sale business. To respond to the continually growing demand for housing, the Company provided condominiums to the masses at affordable prices.

Starting with condominiums in Fujisawa city in 1968, the Company sold condominiums one after another in Tokyo and its suburbs. In 1974, construction began on Totate Zama Heights, the Company's largest condominium for sale at the time, with a developed area of approximately 85,000 square meters and a total of 1,046 units.

Meanwhile, the Company continued to focus on providing housing in Tokyo suburbs. One such symbolic project was Totate Fujimi Heights--a large-scale residential land subdivision whose sales commenced in 1972--straddling the cities of Kawagoe and Tsurugashima-cho, Saitama, with an area of approximately 180,000 square meters and a total of more than 600 plots.

While construction of high-rise buildings showed a declining trend in Japan as a result of the 1965 recession, Tokyo Tatemono continued its aggressive building construction. In the 10-year period since 1967, the Company put 10 new buildings into operation. The expansion of its building business during this time provided an important revenue base for the Company going forward.

1979 - 1995 From an era of enlargement and differentiation to management in a post-bubble economy

-

1.Completing Large-Scale Projects and Launching Tokyo Tatemono Real Estate Sales Co., Ltd.

-

2.Expanding its Business Areas and Diversifying its Business Methods

-

3.Business Development and Improved Profitability in a Post-Bubble Economy

Completing Large-Scale Projects and Launching Tokyo Tatemono Real Estate Sales Co., Ltd.

Since the 1978 oil crisis, the Japanese economy continued to experience sluggish domestic demand, and it was a difficult period for the real estate industry. Building demand decreased and remained stagnant until the mid-1970s.

In 1979, Tokyo Tatemono completed Shinjuku Center Building, boasting 54 stories and a height of 222.95 meters. This was a large project that started in 1967 and took 12 years to complete beginning with the acquisition of a parcel of land at the site of the Yodobashi Water Filtration Plant at the west exit of Shinjuku Station. Although it was difficult to recruit tenants at the time, the building started operations with nearly all spaces occupied, and it became a new symbol for the company.

Meanwhile, the housing market was at a major turning point. The mid-1970s marked an era of capital flow in which the total number of housing units exceeded the number of households and the focus was on replacement demand. To accurately meet the needs of the time, Tokyo Tatemono created the My Home Center brokerage department for private residences in 1979 as an independent sales branch, and in 1980, Totate Housing Services Co., Ltd. was established to specialize in distribution services for existing housing. In 1986, the Company renamed Tokyo Tatemono Real Estate Sales Co., Ltd . to centralize and strengthen businesses related to distribution of existing housing.

Expanding its Business Areas and Diversifying its Business Methods

With the Plaza Accord in 1985, Japan saw the need to shift to a domestic demand-driven economy. The country entered a period of ultra-low interest rates, which led to an economic bubble in the years to come. The real estate market saw a dramatic increase in the number of new companies from other industries.

Amid this situation, the Company focused on responding to customer needs by diversifying its product mix based solely on actual demand, and it promoted differentiation by leveraging its comprehensive capabilities as a general real estate company.

To fully demonstrate its comprehensive capabilities, the Company launched the To-Be system (Tokyo Tatemono Best Planning System) in 1976 and fully deployed it in 1987. Under this system, the Company was able to provide both individuals and businesses comprehensive services to ensure the best use of owned land, from basic planning to business income and expenditure planning, tenant acquisition, and operations and management after building completion. During the period up to 1998, the To-Be system enabled Tokyo Tatemono to complete a total of 135 buildings and condominiums, including the Grand Maison Tamachi and Veil Kugayama condominium buildings and the leased Kuyo Building and Mita Suzuki Building.

During this period, the number of condominium sales projects using the equivalent exchange method increased due to a decrease in prime residential land and an increase in land prices. The Company launched its "Oku-sion" ultra-luxury condominium sales business, and in 1989, it began operations of its Roi Veil series of condominiums.

In the building business, the Company expanded to regional hub cities starting in the mid-1980s with the completion of Tokyo Tatemono Sapporo Building in 1987 and Tokyo Tatemono Nagoya Building in 1991. Meanwhile, in the Tokyo metropolitan area, it expanded into the Shibuya and Aoyama areas with the completion of the Tokyo Tatemono Shibuya Building in 1988 and the Tokyo Tatemono Aoyama Building in 1989.

The Company also participated in large-scale urban redevelopment projects. As one example, the Company completed the Osaki New City complex in 1987 as part of the Osaki Station East Exit redevelopment project, and since then, Tokyo Tatemono has accumulated know-how for large-scale urban redevelopment through its numerous completed projects.

In the resort business, resorts were developed at the four locations of Lake Kawaguchi, Atami, Nasu, and Lake Hatori to meet the changing needs to shift from conventional recreational villas to activity-based resorts with amusement facilities.

Due to the Company's aggressive business expansion efforts, its total assets grew from approximately 40 billion yen in 1979 to approximately 100 billion yen in 1989, an increase of nearly 200%.

Business Development and Improved Profitability in a Post-Bubble Economy

The long-term boom in the real estate industry that started in 1987 began to rapidly slow down in 1990. Despite the downturn, the Company was committed to creating an infrastructure based on management that utilizes true know-how unaffected by fluctuations in land prices.

In the building business, the Company actively promoted activities to acquire tenants using thorough market research and information gathering, and in 1994, it improved vacancy rates even during difficult market conditions. Meanwhile, the condominium sales business began booming back to life in 1992, and in the following year, the Company launched a new strategy and developed five brands for different markets under the new brand name Veil.

With a plan to provide 1,000 units per year, Tokyo Tatemono evolved the five brands into a series of products, from the Roi Veil ultra-luxury condominiums in prime locations of the city to conveniently located Pre-Veil studio condominiums for single people.

In addition to developing its core businesses, the Company entered new businesses and gradually strengthened its management base.

1996 - 2005 New management development in a new century

-

1.Celebrating 100 Years of Business and Trust Beyond the Era

-

2.Group Management Strategy Amid Drastic Changes in the Real Estate Market Environment

-

3.Introducing the Brillia New Condominium Brand Based on a Philosophy of Refinement and Comfort

Celebrating 100 Years of Business and Trust Beyond the Era

1996 marked the 100th anniversary since the founding of Tokyo Tatemono. In addition to formulating the corporate philosophy of "Trust beyond the era" and creating a new logo, in commemoration of 100 years of business, the Company developed three large-scale projects in its operations business that included the Plan-Veil EX fixed-term leasehold condominiums, the Plan-Veil Yokosuka Shioiri seismically-isolated condominiums, and the Hatoriko Highland Regina Forest resort.

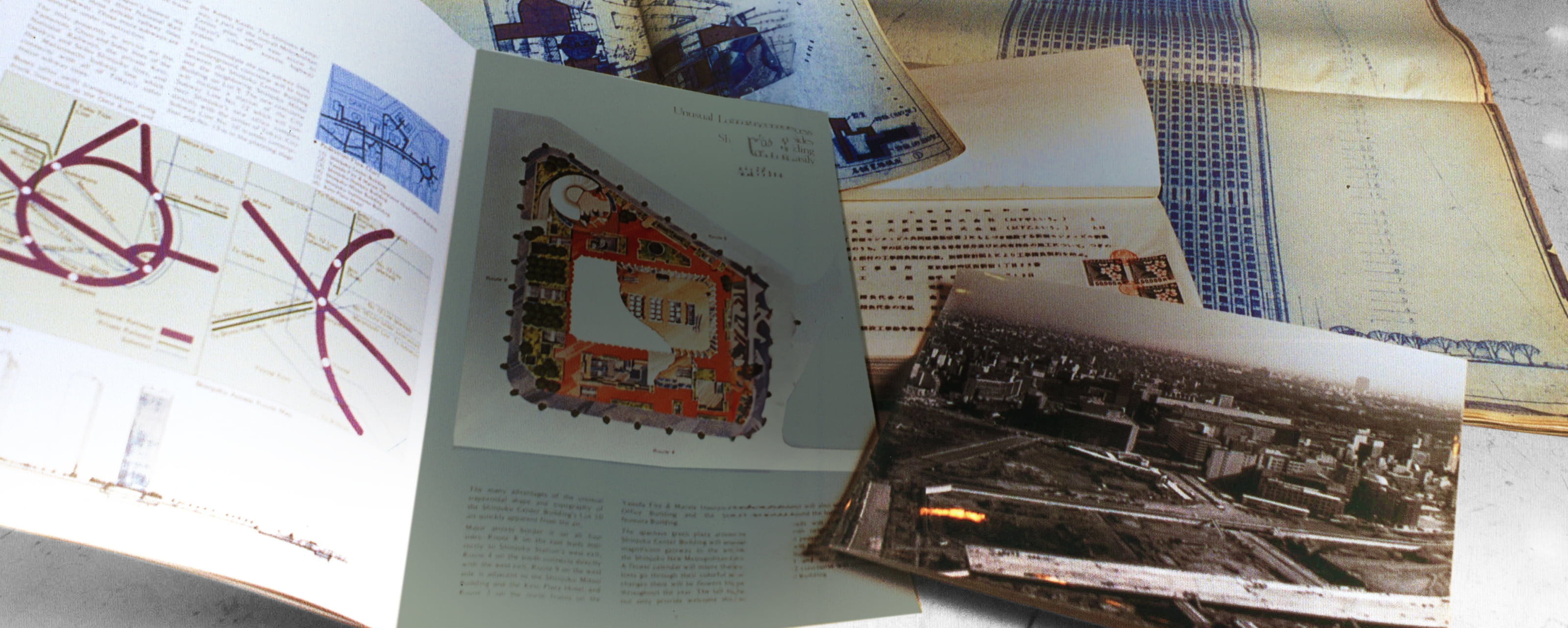

The Japanese economy was in a prolonged slump since the mid-1990s, and various economic measures were put into place. From a policy perspective as well, the liquidation of real estate was encouraged. As the Company entered the next 100 years of business, it proposed shifting to a business based on creating added value, and it aggressively developed new forms of business while responding to the diversification and complexity of business opportunities in the real estate market.

In 1998, the Company received the first registration in Japan for Japan's Special Purpose Company (SPC) Act (Act on Securitization of Assets), and it securitized serviced apartment complex for non-Japanese in Takanawa, Tokyo as Japan's first real estate securitized product using the Act. The following year, in 1999, the Company began sales of "Tokyo Tatemono Invest Fund (No. 3)," a full-scale investment product utilizing the Act on Specified Joint Real Estate Ventures.

Group Management Strategy Amid Drastic Changes in the Real Estate Market Environment

Regulatory reforms were put into place in the early 2000s, and the J-REIT real estate investment trusts market opened in March 2001, dramatically changing the environment surrounding the real estate market. The Company recognized that it needed to respond to a highly specialized and complex business environment rather than simply expanding its business area and business opportunities, and in 2001, it formulated a group management strategy and focused on maximizing created added value through collaboration and business model innovation through strategic use of IT.

In 2000, prior to the opening of the J-REIT market, the Company established the asset management company Tokyo Realty Investment Management, Inc. (current Tokyo Tatemono Realty Investment Management, Inc.) The following year, in 2001, it formed the predecessor fund of Japan Prime Realty Investment Corporation (JPR) together with three companies including Yasuda Life Insurance Company (current Meiji Yasuda Life Insurance Company). In June 2002, JPR was listed on the J-REIT market of the Tokyo Stock Exchange.

To expand its Internet business for real estate transactions, the Company established E-State Online Co., Ltd. in 2001 for operation of a comprehensive real estate website. In 2005, the Company ambitiously developed its online operations, and Tokyo Tatemono Real Estate Sales Co.,Ltd. launched the industry's first Internet branch.

Meanwhile, the Company steadily built up a track record in the redevelopment business utilizing special purpose companies (SPCs). In 2002, an SPC formed by the Company acquired 20 real estate properties owned by Iwataya, a long-established department store in Fukuoka, in the central Tenjin area. Tokyo Tatemono used its expertise in the comprehensive real estate industry to renovate properties, and it opened several commercial buildings including Nishijin Ellemall Praliva shopping mall and the VIORO shopping facility. In 2005, an SPC formed by the Company opened DICE, a next-generation commercial facility in front of the Keikyu Kawasaki Station as Japan's first SPC standalone legal redevelopment project.

From this period, large-scale urban redevelopment and urban revitalization projects gained momentum, and Tokyo Tatemono was also committed to urban revitalization in various forms. In 2003, the Company participated as a principal member of the Central Government Building No. 7 Project, the first PFI project in urban development by the Ministry of Land, Infrastructure, Transport and Tourism. In 2007, the project was completed with the structure renamed Kasumigaseki Common Gate.

One of our representative architectural successes, Otemachi Tower, got its start in 2004 after an SCP formed by the Company acquired the Mizuho Bank Otemachi Head Office Building and Otemachi Financial Center.

Introducing the Brillia New Condominium Brand Based on a Philosophy of Refinement and Comfort

Tokyo Tatemono enjoyed a major breakthrough period in the sale of condominiums and houses. In April 2003, the Company consolidated the Veil series of condominiums with five separate brands under the new Brillia brand. Sales of the first product of the brand, Brillia Chofu Kokuryo, began in July of the same year.

In September 2004, the Company began building single-family homes under the new brand Brillia Terrace by adopting the Brillia brand identity. Sales commenced with the first such housing area, Brillia Terrace Yokohama Sora no Machi.

Since then, the Brillia brand has continued to gain support, and 2023 marked its 20th year. Backed by this brand of new condominiums that is close to people's daily lives and offers refinement and comfort, Tokyo Tatemono continues to provide homes so that people can pursue an affluent lifestyle that changes with the times.

2006 - 2019 Urban development that leads to the creation of added value in the future

-

1.Strengthening Environmental Efforts While Revitalizing the City and Region

-

2.Responding to Changes in Society and Launching Diverse Businesses

-

3.Using Abundant Know-how to Participate in Various Projects in China and ASEAN Countries

Strengthening Environmental Efforts While Revitalizing the City and Region

The subprime crisis from 2007 to 2009 and the subsequent stagnation of the Japanese economy coupled with asset deflation had a considerable impact on the real estate industry. Amid these conditions, the Company was able to leverage its accumulated expertise to start various large-scale redevelopment projects. With the aging of buildings constructed around the period of high growth and a change in the industrial structure, there was a growing need to revitalize the city and region and provide urban development with added value.

In one such case, the Company was selected in 2007 as a collaborator for the Suwa 2-chome Housing Reconstruction Project, in which 640 units were rebuilt in one of Japan's largest projects at the time, and the Company promoted the project based on the Tama New Town Renaissance Concept as a "people-friendly town." Brillia Tama New Town was completed in 2012.

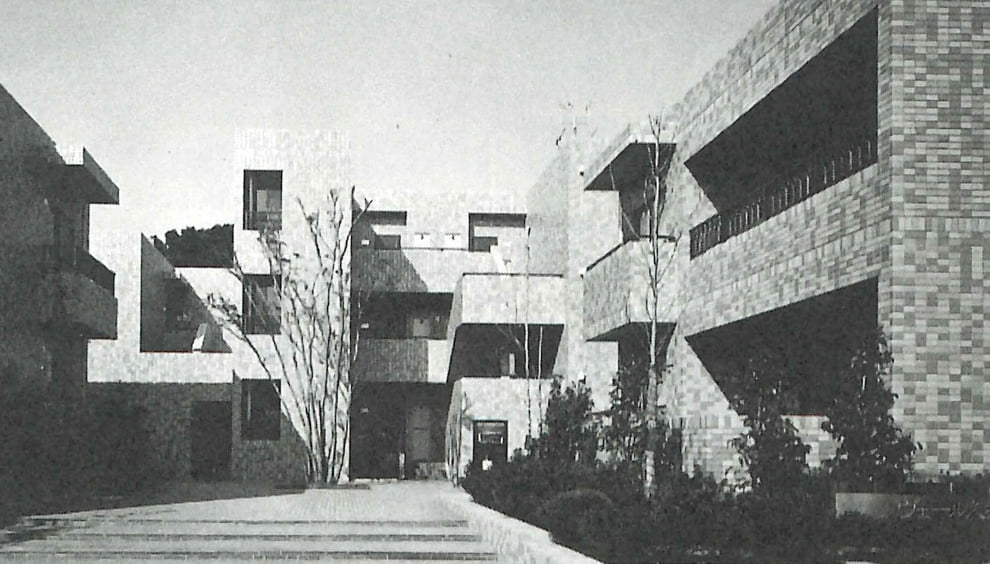

During the same year, Tokyo Tatemono participated in a competitive bidding process for the site of the relocated police academy facility and won the bid. The Company developed a large-scale complex comprising offices, commercial facilities, and homes on a vast site of approximately 3.5 hectares. Nakano Central Park, completed in 2012, offers an innovative workstyle that brings nature to the office.

In 2015, Tokyo Tatemono completed Brillia Tower Ikebukuro, Japan's first integrated large-scale redevelopment project that brought together the new government office of Toshima Ward and ultra-high-rise condominiums.

From this period, environmental considerations became a strong requirement in building design. The Company formulated the Brillia Environmental Guidelines in 2009 and the Group Environmental Policy in 2011, and it has promoted various activities through its business activities by reducing the environmental load and improving the energy efficiency and environmental performance of buildings.

Tokyo Square Garden, completed in 2013, not only boasted top-level environmental performance in Japan at the time by using natural and renewable energy and visualizing its energy savings, but it also provides a greenery space of approximately 3,000 square meters called Kyobashi no Oka, which is a multilayered structure of approximately 31 meters high, stretching from the first basement floor to the fifth floor above ground.

Otemachi Tower, completed in 2014, is one of the flagship properties of Tokyo Tatemono and is home to the Mizuho Bank Head Office and Aman Tokyo luxury hotel. It also houses the roughly 3,600-square-meter Otemachi Forest, covering nearly one-third of the entire site, helping revitalize the city and nature.

Brillia Tower Seiseki Sakuragaoka BLOOMING RESIDENCE, completed in 2019, was adopted as the first in the Tokyo metropolitan area for the FY 2019 super high-rise net zero energy condominium (ZEH-M) demonstration project by the Ministry of Economy, Trade and Industry and was certified as ZEH-M Oriented.

Responding to Changes in Society and Launching Diverse Businesses

In response to changes in society and to meet the demands of the time, the Company launched new, diverse businesses in the 2010s.

In 2012, the Company launched the Brillia bloomoi project with the aim of supporting the activities of women and realizing homes that meet the diversified needs of working women through dialogue and empathy. In 2022, to commemorate 10 years of operation, the project has evolved by proposing a way of life in line with diverse values and lifestyles irrespective of age or gender.

In 2014, the Company established Tokyo Tatemono Senior Life Support Co., Ltd., using the know-how cultivated from the Grapes series housing for elderly that includes services. In addition to expanding its senior housing business, the Company has also started fee-based nursing home operations.

In 2015, to further enhance the value of the Brillia brand, Tokyo Tatemono Real Estate Sales Co.,Ltd. became a wholly owned subsidiary and consolidated the development, sales, and management functions of the housing business.

Meanwhile, as the economic policy of "Abenomics" aimed at overcoming deflation was being promoted, the National Strategic Special Zone Act came into effect in 2013, stimulating urban revitalization, especially in central Tokyo. The Company was able to leverage its accumulated expertise in urban redevelopment to participate in numerous urban redevelopment projects. The Yaesu Project (Urban Redevelopment Project for Yaesu 1-Chome East Area in Front of Tokyo Station (Districts A and B)), the large-scale urban redevelopment project to be undertaken in front of Tokyo Station was also approved as a specific project of the National Strategic Special Act in 2015.

Using Abundant Know-how to Participate in Various Projects in China and ASEAN Countries

Amid the push for globalization, Tokyo Tatemono has actively embarked on overseas business since the mid-2000s. It established local subsidiaries in Shanghai in 2006 and in Singapore in 2014, and in addition to developing a housing development business in China, the Company has expanded its business in Singapore, Thailand, and other countries.

In China, in 2006, the Company collaborated with a leading local developer group and became the first Japanese general real estate company to participate in the condominium sale business in Shanghai. Thereafter, it completed the Yangzhou Project, a condominium development in Yangzhou, Jiangsu Province from 2010 to 2016 and the Shenyang Tomorrow Square Project, a mixed-use development comprising condominiums, commercial facilities, and office buildings in Shenyang, Liaoning Province from 2013 to 2018.

The cumulative number of housing units supplied in China in 2020 exceeded 25,000, the largest by a Japanese company. (As of 2020, based on in-house research)

2020 - Today Becoming a Next-Generation Developer

-

1.Strengthening its Large-scale Redevelopment Business and Condominium Business

-

2.Solving Social Issues Through Business

Strengthening its Large-scale Redevelopment Business and Condominium Business

Tokyo Tatemono has always been committed to participating in redevelopment projects in the Yaesu-Nihonbashi-Kyobashi (YNK) area of Tokyo, and in the 2020s, the Company further deepened its relationship with the region, which has been home to its head office since its founding.

In 2021, construction was started on the Yaesu Project (Urban Redevelopment Project for Yaesu 1-Chome East Area in Front of Tokyo Station (Districts A and B)), an urban redevelopment project in the city blocks in front of Tokyo Station that includes the Company's former head office building, with the aim of improving the aesthetics of the city with an underground bus terminal, pedestrian spaces, and an event area that includes a theater, conference hall, and public open spaces. The Company promotes its business together with rights holders.

The Company is working to enhance the attractiveness of the Yaesu-Nihonbashi-Kyobashi area and contribute to the development of Tokyo as an international city by participating in multiple projects including the Gofukubashi Project (Urban Redevelopment Project for Yaesu 1-chome North Area) and Kyobashi 3-chome Project (Urban Redevelopment Project for Kyobashi 3-chome East Area).

Tokyo Tatemono is also strengthening its business in rural areas. In Fukuoka, it worked on the Nishijin Reborn Project, integrating the Brillia Tower Nishijin high-rise condominiums and a commercial facility, following the closure of Nishijin Ellemall Praliva, the commercial shopping mall, and construction was completed in 2021. The creation of a publicly open rooftop garden directly connected to the subway station as well as the construction of a new passageway that provides pedestrian flow have greatly contributed to creating a vibrancy in the entire area.

Solving Social Issues Through Business

In 2020, the Tokyo Tatemono Group formulated a long-term vision, "Becoming a Next-Generation Developer" with 2030 as a target year for its SDGs. The Group aims to achieve a high-level balance between providing solutions to social issues and pursuing corporate growth.

One such project to help realize this is Hareza Ikebukuro, which was completed in 2020. The redevelopment concept of creating "a theatercity where everyone can shine" proposed by three companies and led by Tokyo Tatemono as the representative business operator was well received by Toshima City, who selected the Company as a developer. The large-scale multi-purpose facility has eight theaters and plays a major role in community development to help solve local issues in the Ikebukuro area. The Hareza Tower office building is the first super high-rise mixed-use building over 150 meters tall to receive Japan's ZEB Ready certification given to buildings equipped with high-efficiency energy-saving equipment.

The Company will continue to promote sustainable, high-value-added urban development to help provide solutions to social issues through business.