Risk Management

Policy and Concept

In order to sustain our business activities in the face of significant changes in the external environment, including a decline in the total domestic population and working-age population, and an increase in geopolitical and natural disaster risks, the Tokyo Tatemono Group has identified strengthening our risk management framework as one of our material issues. The Tokyo Tatemono Group seeks to appropriately manage risks that could affect the Group's business to achieve stable improvement in corporate value. With this in mind, we have established related regulations, created a risk management framework, and are carrying out ongoing risk monitoring and control.

Structure

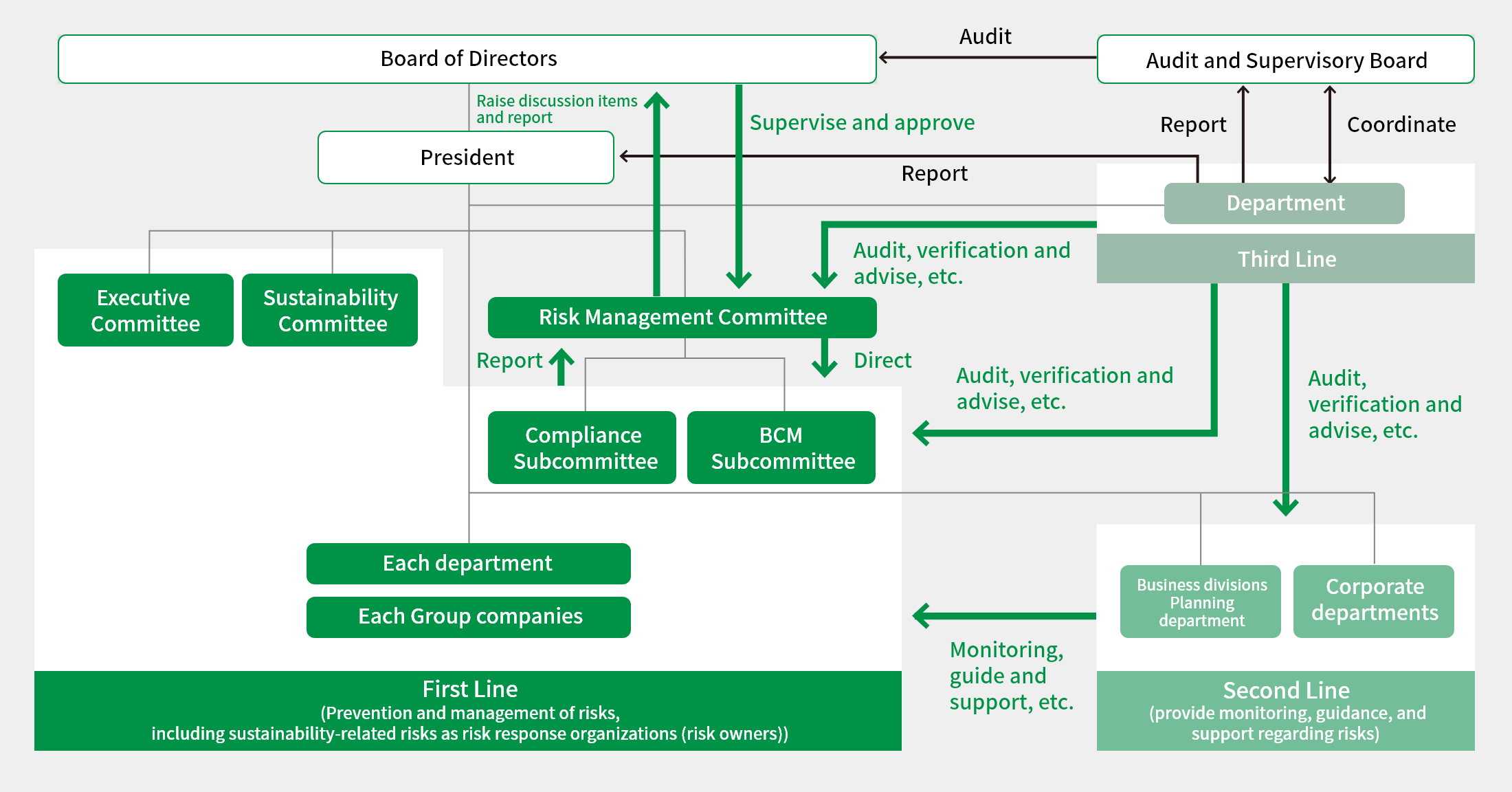

To centrally manage risk throughout the Group, Tokyo Tatemono established its Risk Management Committee chaired by the President.

The Risk Management Committee formulates annual plans for the risk management of the Tokyo Tatemono Group, evaluates and analyzes risks that are important to management (priority risks), formulates preventive measures and countermeasures, and periodically monitors the status of countermeasures.

In addition, we have established a unified risk management structure consisting of the head of each division as the Risk Management Officer responsible for managing risk within their respective departments, and the President as the Chief Risk Management Officer, who centrally oversees company-wide risk.

Furthermore, by adopting the principles of the Three Lines Model, we aim to maintain and enhance the effectiveness of our risk management efforts.

For risks other than priority risks (departmental management risks), in addition to the general managers of each department who are risk management officers, various committees and Group companies act as risk response organizations (risk owners) (the First Line) to appropriately prevent and manage the risks, reporting to the Risk Management Committee. The corporate departments and the planning departments of each business division (the Second Line) monitor and provide support and guidance regarding risk management at each department. The Internal Audit Department (the Third Line) audits and provides advice, from an independent standpoint, regarding the risk management of the corporate departments and planning departments of each business division. Also, the Risk Management Committee operates independently of the Audit and Supervisory Board and the Chief Risk Management Officer (Tokyo Tatemono's President) is not a member of the Audit and Supervisory Board.

The Sustainability Committee acts as the risk response organization (risk owner) to manage sustainability risks in cooperation with relevant departments, and reports key matters in its activities to the Risk Management Committee.

Important matters deliberated by the Risk Management Committee, such as the risk management structure, policies, and annual plans, as well as the status of risk management efforts, are submitted to or reported to the Board of Directors. The Board supervises the effectiveness of the Group's overall risk management, including sustainability-related risks.

-

*The Group's risk management structure was developed with reference to the following external standards and frameworks.

-

・ISO 31000: An international standard for risk management

-

・Enterprise Risk Management (ERM): An enterprise-wide risk management framework released by the Committee of Sponsoring Organizations of the Treadway Commission (COSO)

-

・Three Lines Model: Released by the Institute of Internal Auditors (IIA)

Risk Management Structure