Disclosure Based on TCFD Recommendations

Disclosure Based on TCFD Recommendations

Governance

Tokyo Tatemono established the Sustainability Committee, chaired by our president, as a group-wide framework to promote cross-functional and continuous sustainability initiatives, including those addressing climate change, along with the Sustainability Promotion Committee as a subordinate organization.

The Sustainability Committee, like the Executive Committee, Risk Management Committee and Internal Control Committee, is under the direct control of the president. It meets, in principle, at least twice a year to deliberate, discuss and report matters related to the formulation of policies for promoting the Group's sustainability initiatives, the development of the organizational structure, the setting of indicators and targets, the monitoring and evaluation of progress. With regard to climate change, the Group's Sustainability Committee deliberates, discusses, and reports important matters, such as the identification of related risks and opportunities, medium-to long-term targets for reducing greenhouse gas (GHG) emissions, and specific measures for reaching such goals.

Important matters deliberated and discussed by the Sustainability Committee are submitted to or reported to the Board of Directors. The Board supervises the overall promotion of the Group's sustainability initiatives by making decisions on important sustainability-related matters and implementing monitoring of response measures.

The Sustainability Promotion Committee facilitates the sharing of Sustainability Committee decisions, conducts preliminary discussions for consideration, and reports on the progress of the Group's sustainability initiatives.

Strategy (scenario analysis)

Tokyo Tatemono uses scenario analysis to identify climate change risks and opportunities and to evaluate their importance and impact on the Group's financial interests.

STEP1 : Setting Up Scenarios

For our scenario analysis, we set up future worlds (scenarios). Drawing from scenarios published by the Intergovernmental Panel on Climate Change (IPCC*1) and the International Energy Agency (IEA*2), we based our analysis on the following scenarios: a 4°C scenario as the current trajectory, in which the average temperature rises by 4°C or more above pre-industrial levels by 2100; a 2°C scenario as a transition scenario, which limits the increase to below 2°C; and a 1.5°C scenario, which further limits the temperature rise to 1.5°C.

-

IPCC (Intergovernmental Panel on Climate Change): The IPCC is an institution that provides clear scientific opinions of the status of climate change and its socioeconomic impact.

-

IEA (International Energy Agency): The IEA is an independent body within the OECD that facilitates policy cooperation on energy and energy security.

The Scenarios Used in the Analysis

| Scenarios | Scenario analysis | Reference scenario |

|---|---|---|

| 4°C scenario | A scenario in which the average temperature rises by about 4°C compared to pre-industrial levels as a result of failure to introduce stricter government policies and strengthen regulations, such as regulations to curb GHG emissions, and of failure by businesses and other entities to take effective action in response to climate change. Acute effects include more frequent extreme weather events and more intense heavy rainfall, while chronic effects include rising sea levels. | IPCC SSP5-8.5 (RCP 8.5) IEA STEPS |

| Scenarios | Scenario analysis | Reference scenario |

|---|---|---|

| 1.5C/2°C scenario | A scenario in which the average temperature rise compared to pre-industrial levels is kept below 1.5°C or 2°C by improving low-carbon technologies, expanding renewable energy, and promoting energy conservation. In this scenario, companies and other entities are strongly required to respond to climate change by introducing carbon taxes and strengthening policies to regulate emissions in order to curb GHG emissions. | IPCC SSP1-1.9 (RCP 2.6) IEA NZE IEA SDS |

STEP2 / STEP3 : Identifying Risks / Opportunities and Assessing Materiality

Focusing on the Group's core businesses, the Commercial Properties Business and Residential Business, we identified the main climate change risks and opportunities and assessed their materiality in terms of their expected degree of impact on the Group's finances and likelihood of occurrence. The period of impact was categorized into short-term (1-5 years), medium-term (5-10 years), and long-term (>10 years).

Identified Risks, Opportunities, and Materiality Concerning Climate Change

| Category | Item | Impact on Group business | Period of impact | Materiality | ||

|---|---|---|---|---|---|---|

| 4°C scenario | 1.5°C/2°C scenario | |||||

|

Transition risks |

Policies |

Adoption of carbon pricing |

Imposition of carbon tax on own emissions (Scope 1 and 2) |

Medium-term |

ー |

Medium |

|

Price hikes for construction materials, construction costs, etc. |

Medium-term |

ー |

Medium |

|||

|

Regulations |

Stricter standards for GHG emissions and energy saving |

Higher costs of converting new buildings to ZEB/ZEH |

Medium-term |

Low |

Low |

|

|

Higher costs of introducing decarbonized building materials |

Medium-term |

Medium |

Medium |

|||

|

Increase in cost of energy-saving renovation of existing buildings |

Medium-term |

Low |

Low |

|||

|

Technology and markets |

Higher unit cost of grid electricity |

Higher utility costs due to change in energy mix |

Short- to medium-term |

ー |

Low |

|

|

Higher utility costs due to higher demand for fossil fuels |

Short- to medium-term |

Low |

ー |

|||

|

Burden from renewable energy procurement |

Higher renewable energy procurement costs |

Short- to medium-term |

Low |

Low |

||

|

Reputation |

Ensuring disaster preparedness and resilience |

Higher costs of ensuring disaster preparedness and resilience |

Short-term |

Low |

Low |

|

|

Physical risks |

Acute |

Frequent and intense extreme weather events caused by extratropical and tropical cyclones, etc. |

Higher costs due to construction delays caused by supply chain paralysis or disruption |

Short-term |

ー |

ー |

|

Countermeasures for decreased work efficiency at construction sites due to frequent heat waves and high temperatures, and increased costs from construction delays. |

Short-term |

ー |

ー |

|||

|

Loss of rental income in the event of flooding caused by heavy rainfall and river flooding |

Short-term |

Low |

Low |

|||

|

Higher restoration costs arising from storm and flood damage affecting buildings |

Short-term |

Low |

Low |

|||

|

Higher insurance premiums |

Short-term |

Low |

Low |

|||

|

Chronic |

Rise in average temperature |

Higher utility costs |

Short-term |

Low |

Low |

|

|

Opportunities |

Technology |

Efficiency improvements with ZEB and ZEH development |

Reduction of utility costs |

Short-term |

Low |

Low |

|

Procurement of renewable energy through self-consignment |

Reduction in utility costs and renewable energy procurement costs |

Short-term |

Low |

Low |

||

|

Consumer behavior |

Improved earnings from high environmental performance properties |

Higher sales due to higher evaluation of ZEB/ZEH |

Short- to medium-term |

ー |

Medium |

|

|

Improvement of energy-saving effects |

Addition of energy-saving effects to rental income |

Short- to medium-term |

ー |

Low |

||

|

Markets |

Expansion of Sustainability Finance |

Reduction in financing costs |

Short-term |

ー |

Low |

|

STEP4 : Estimating Business Impact

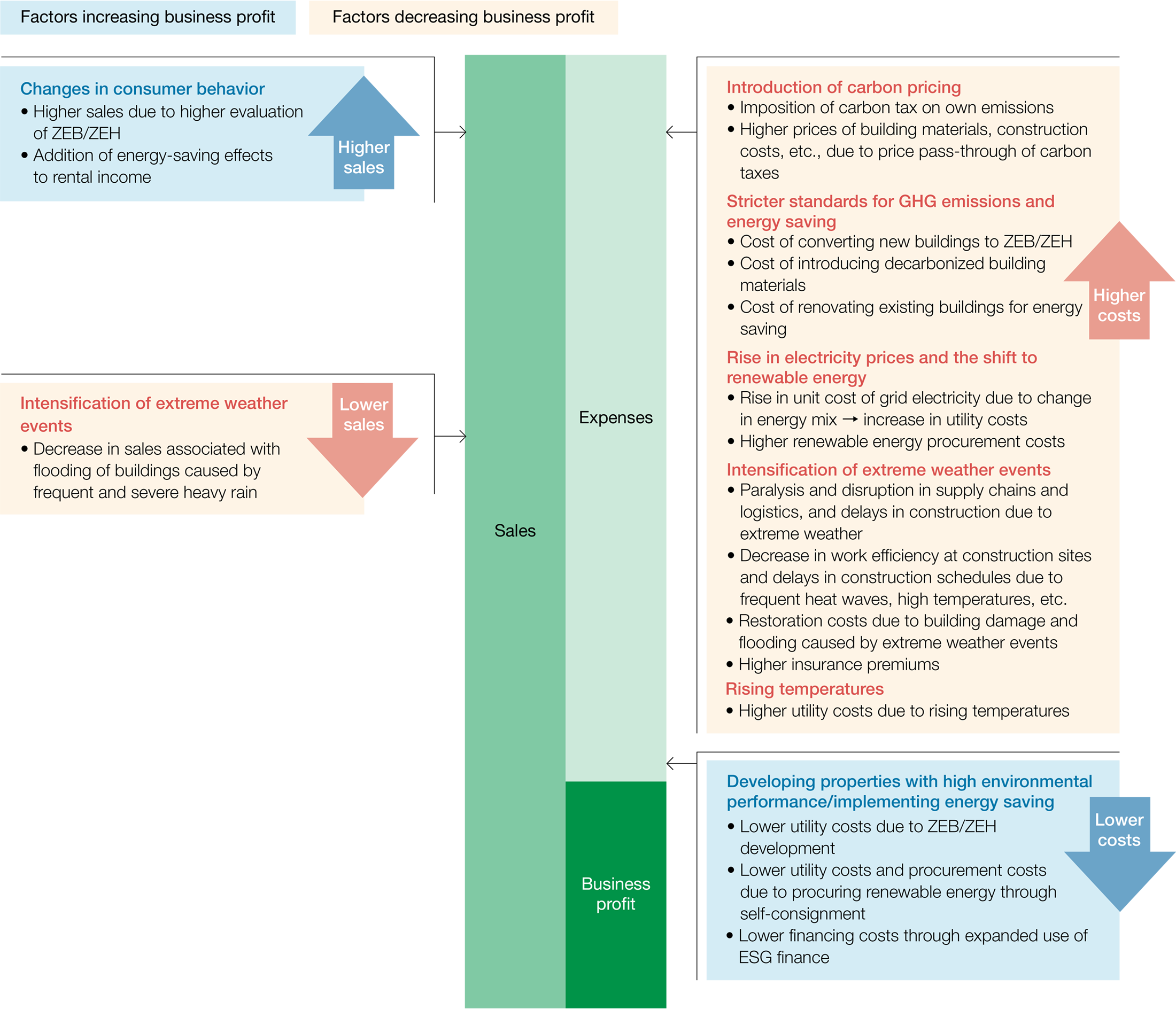

We quantitatively assess the identified climate change risks and opportunities for their impact on the Group's 2030 financials. When quantitative prediction and analysis are not feasible for certain risks and opportunities, we conduct a qualitative analysis.

Countermeasures

Tokyo Tatemono has Group identified "Promoting a Decarbonized Society" as one of the Group's material issues and is working to address this challenge through its business activities by setting the medium- to long-term targets for reducing GHG emissions of reducing Scope 1 and 2 CO2 emissions by 46.2%*1 from fiscal 2019 levels by fiscal 2030, and reducing Scope 3*2 emissions by 40% over the same period. The Group also aims to achieve net-zero CO2 emissions for Scope 1, 2, and 3 by fiscal 2050. In addition, to help achieve these targets, we have established and are actively pursuing process goals, including the promotion of development of ZEB and ZEH, the shift to renewable energy, and the acquisition of green building certification. At the same time, we are also focusing efforts on the development of resilient real estate and communities designed to withstand natural disasters such as wind and flood damage, which are occurring more frequently due to climate change. For more information, see Initiatives to Achieve GHG Emission Reductions .

-

The level required to limit the rise in global average temperature to 1.5°C compared to pre-industrial levels.

-

Applies to Categories 11 and 13.

Impact on the Tokyo Tatemono Group's Business Profit

Risk Management

To centrally manage risk throughout the Group, Tokyo Tatemono established its Risk Management Committee chaired by the President. The Risk Management Committee develops the Group's annual risk management plan, evaluates and analyzes critical operational risks (high-priority risks), formulates preventive and response measures, and regularly monitors the implementation of risk management efforts. In addition, we have established a unified risk management structure consisting of the head of each division as the Risk Management Officer responsible for managing risk within their respective departments, and the President as the Chief Risk Management Officer, who centrally oversees company-wide risk.

Furthermore, by adopting the principles of the Three Lines Model, we aim to maintain and enhance the effectiveness of our risk management efforts. Details of the risk management framework are provided in Risk Management.

Sustainability-related risks are managed by the Sustainability Committee in coordination with relevant departments, and important matters regarding implementation status are reported to the Risk Management Committee. Important matters deliberated by the Risk Management Committee, such as the risk management structure, policies, and annual plans, as well as the status of risk management efforts, are submitted to or reported to the Board of Directors. The Board supervises the effectiveness of the Group's overall risk management, including sustainability-related risks.

Indicators and Targets

Tokyo Tatemono has established indicators and goals (KPIs and targets) related to Promoting a Decarbonized Society, one of its identified material issues, and is working on various initiatives while quantitatively monitoring progress each fiscal year.

| Item | Scope of coverage | KPIs and targets | |

|---|---|---|---|

| Reduction in greenhouse gas emissions | All Businesses*1 | Scope 1, 2, and 3 | Net zero CO₂ emissions by FY2050 |

| Scope 1 and 2 | 46.2% reduction in CO₂ emissions compared to FY2019 levels by FY2030 | ||

| Scope 3 *2 | 40% reduction in CO₂ emissions compared to FY2019 levels by FY2030 | ||

| Promotion of development of ZEB and ZEH*3 | Commercial Properties Business | Develop ZEB for, in principle, all new office buildings and logistics properties*4 | |

| Residential Business | Develop ZEH for, in principle, all new condominiums for sale or rent*5 | ||

| Shift to renewable energy | All Businesses*1 | Procure 100% of electricity consumed in business activities from renewable energy sources by FY2050 | |

| Commercial Properties Business | Procure 100% of electricity consumed at owned properties from renewable energy sources by FY2030 | ||

| Procure at least 50% of electricity consumed at owned properties from renewable energy sources by FY2024 | |||

| Acquisition of Green Building Certification*6 | Commercial Properties Business, Residential Business | Acquire Green Building Certification for, in principle, all new office buildings, logistics properties, and condominiums for rent*7 | |

-

Applies to Tokyo Tatemono Group.

-

Applies to Scope 3 categories 11 and 13.

-

In addition to "ZEB" and "ZEH(-M)", includes Nearly ZEB, ZEB Ready, ZEB Oriented, Nearly ZEH(-M), ZEH(-M) Ready, and ZEH(-M) Oriented.

-

Applies to new buildings for which design work began in January 2023 or later.

Excludes certain properties such as joint venture properties or properties with special uses. -

Applies to new buildings for which design work began in June 2021 or later.

Excludes certain properties such as joint venture properties or properties with special uses. -

Mainly refers to, but is not limited to, DBJ Green Building Certification, CASBEE building and BELS (Building Energy Saving Performance Labeling System) certification.

-

Applies to new buildings for which design work began in January 2023 or later.

Excludes certain properties such as joint venture properties or properties with special uses.

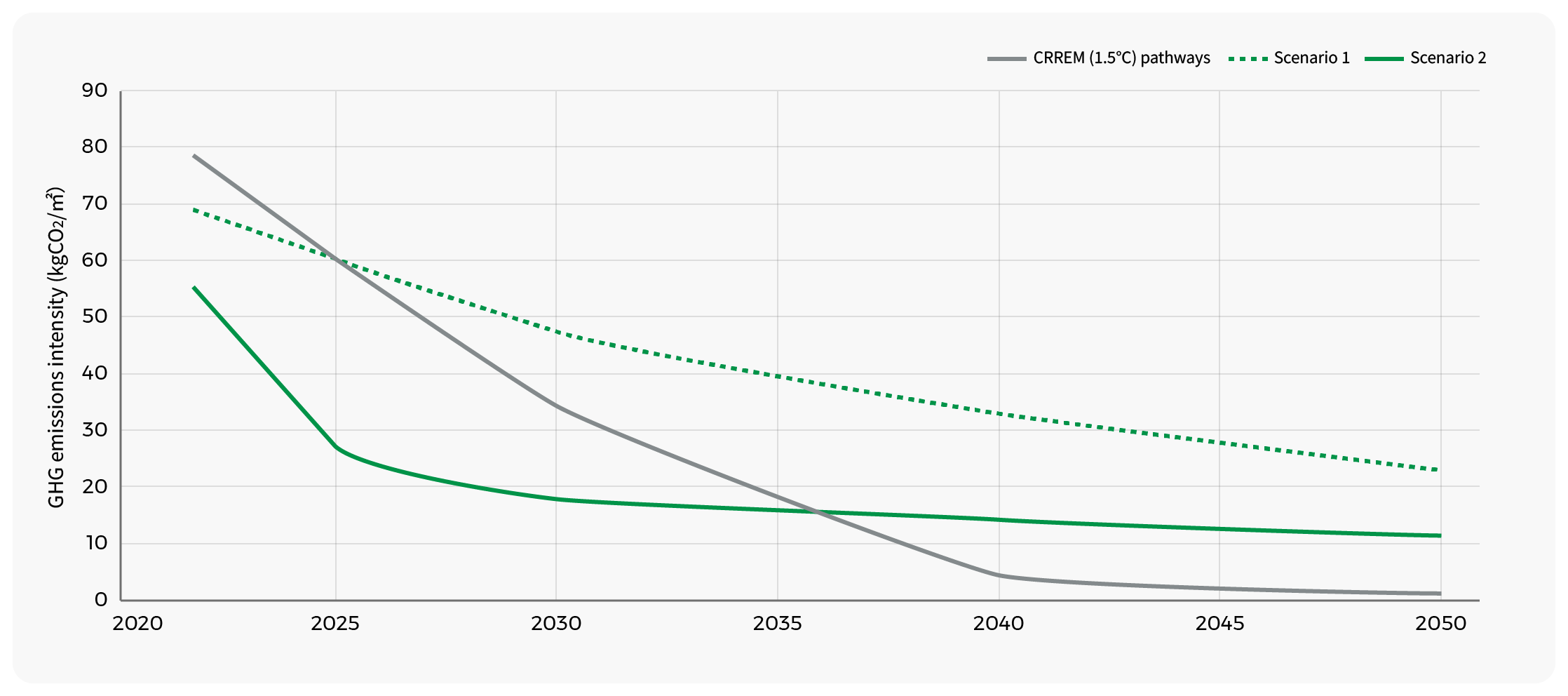

Transition Risks Analysis with CRREM

Analysis overview

CRREM (Carbon Risk Real Estate Monitor) calculates and publishes the greenhouse gas (GHG) emissions pathways (decarbonization pathways) to 2050 that are consistent with the 2℃ and 1.5℃ targets required by the Paris Agreement for each property type in Europe, North America and Asia-Pacific including Japan, and also publishes a tool to visualise some of the transition risks by comparing the GHG emissions pathways of the analysed buildings with the CRREM pathways. CRREM analysis using this tool is expected to be used for operational improvements, such as calculating when GHG emission pathway of the analysed buildings will exceed the CRREM pathways (becoming a stranded asset) and future carbon costs, and identifying the scale of retrofitting required to address these issues.

In order to analyse the risks in the transition to a decarbonized society consistent with the 1.5℃ targets required by the Paris Agreement, we conducted the CRREM analysis* of our long-term building holdings (as at end-December 2022, hereafter 'our portfolio').

In accordance with CRREM's analysis methodology, we compared the GHG emissions pathways of our portfolio with the CRREM pathways consistent with the 1.5℃ targets for the following two scenarios.

Scenario 1) is the case in which, in our portfolio, operations to promote energy savings, upgrades to high-efficiency equipment and the introduction of Raw Green Power, such as on-site power generation and self-consumption, self-consignment and corporate PPAs are taken into account.

Scenario 2) is the case in which, in addition to the initiatives in Scenario 1), the introduction of renewable energy through switching to electricity using Non-fossil Fuel Certificates with Tracking and purchasing non-fossil certificates is taken into account.

In addition, the Tokyo Tatemono Group has established medium- and long-term targets for reducing GHG emissions and, to achieve these targets, we are taking various initiatives towards decarbonization, including promoting the development of ZEB/ZEH, shifting to renewable energy and acquiring green building certification. The results of the analysis of scenario 2) of the above scenarios, which is close to our initiatives, are therefore discussed below.

-

We used CRREM v2.03 in this analysis. It is based on the Asia-Pacific version, with some parameters (e.g. emission factors for grid electricity) adjusted to suit the actual situation in Japan.

Analysis results

Although GHG emissions from electricity will be reduced through the shifting to renewable energy, and GHG emissions from various energy sources will be reduced through operations to promote energy saving and upgrades to high-efficiency equipment, some GHG emissions from fuels such as gas and heat such as district heating and cooling will remain, which means that before 2040 the our portfolio pathways is expected to exceed the CRREM pathways.

In this analysis, it was assumed that our portfolio as of the end of FY2022 will not be replaced in the future, however in reality, GHG emissions from our long-term buildings are expected to be further reduced by reconstructing to energy-efficient buildings and replacing buildings to energy-efficient buildings.

Strategies based on the results of the analysis

We will continue to operate to promote energy saving, upgrade to high-efficiency equipment and shift to renewable energy, as well as reconstruct to energy-efficient buildings and replace buildings to energy-efficient. In addition, for new buildings to be developed in the future, we will develop ZEB/ZEH and green buildings and work on the introduction of renewable energy to increase the proportion of buildings with low GHG emissions in our long-term holdings and reduce GHG emissions in the future.