Long-term Vision,

Medium-term Business Plan

Please refer to the following for our long-term vision for 2030 and our medium-term business plan.

2025/01/17

Medium-term Business Plan (2025-2027) Presentation

Overview of the Long-term Vision, Medium-term Business Plan

In 2020, the Tokyo Tatemono Group announced its long-term vision, "Becoming a Next-Generation Developer," which is focused on the year around 2030. The group has been working to become a "good company" for all stakeholders by leveraging its businesses to solve social issues and achieve higher levels of growth as a company.

Since then, the business environment in which we find ourselves has become even more uncertain, and the pace of change has accelerated due to factors such as behavioral changes among people caused by the new coronavirus infection, heightened geopolitical risks, a shift from the monetary easing policy of the other dimension, and a sharp increase in construction costs due to inflation and other factors.

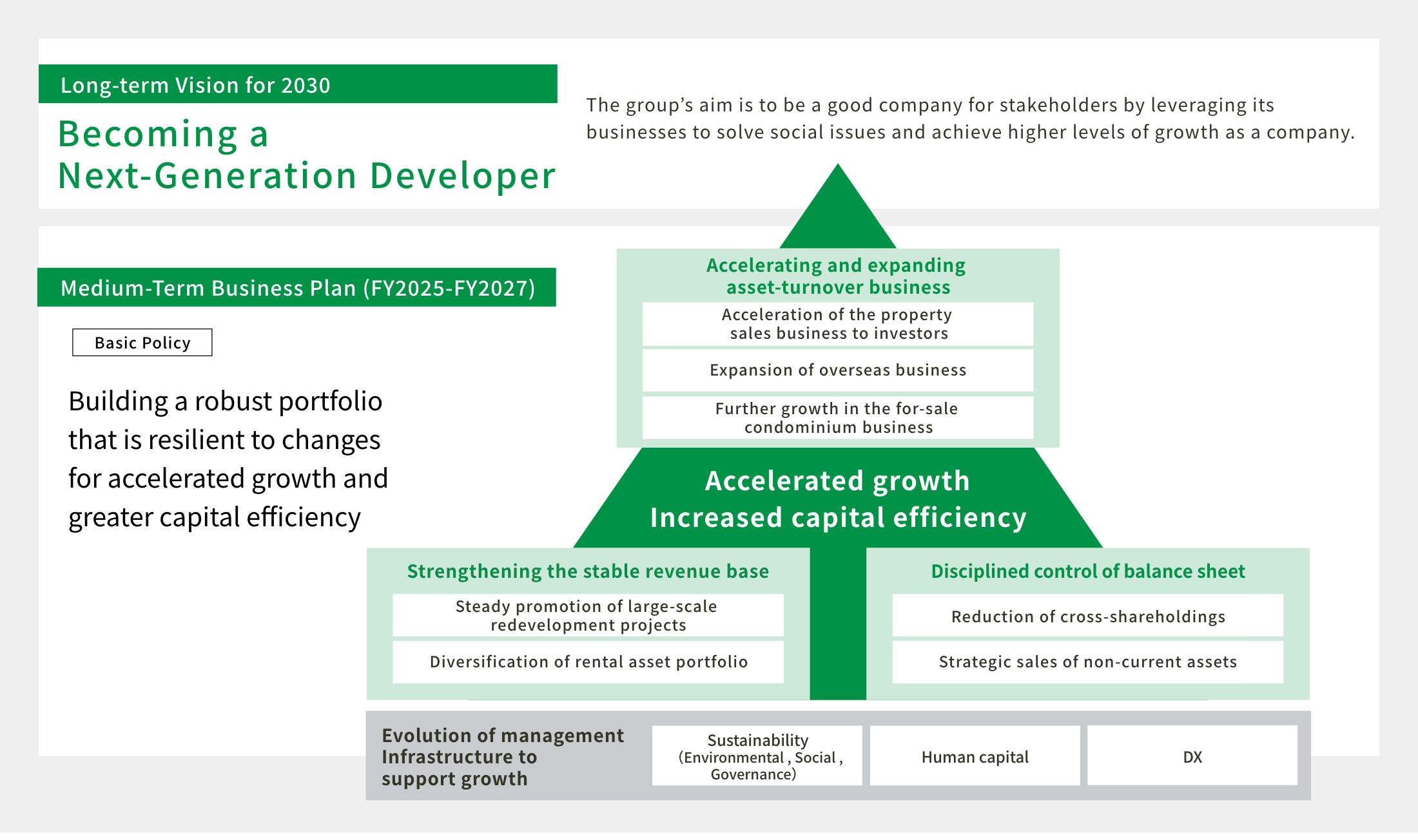

Based on this recognition, we have formulated a new Group medium-term business plan covering the three-year period from FY2025 to FY2027, and have also reviewed our long-term vision by clarifying the target year to 2030.

Long-term Vision for 2030

In an era full of uncertainty and rapid change in terms of demographics, diverse values, accelerating technological progress, and more, various issues have emerged on the path to creating a sustainable society.

The Tokyo Tatemono Group recognizes that the role developers play must also change significantly.

The group's aim is to be a good company for stakeholders by leveraging its businesses to solve social issues and achieve higher levels of growth as a company.

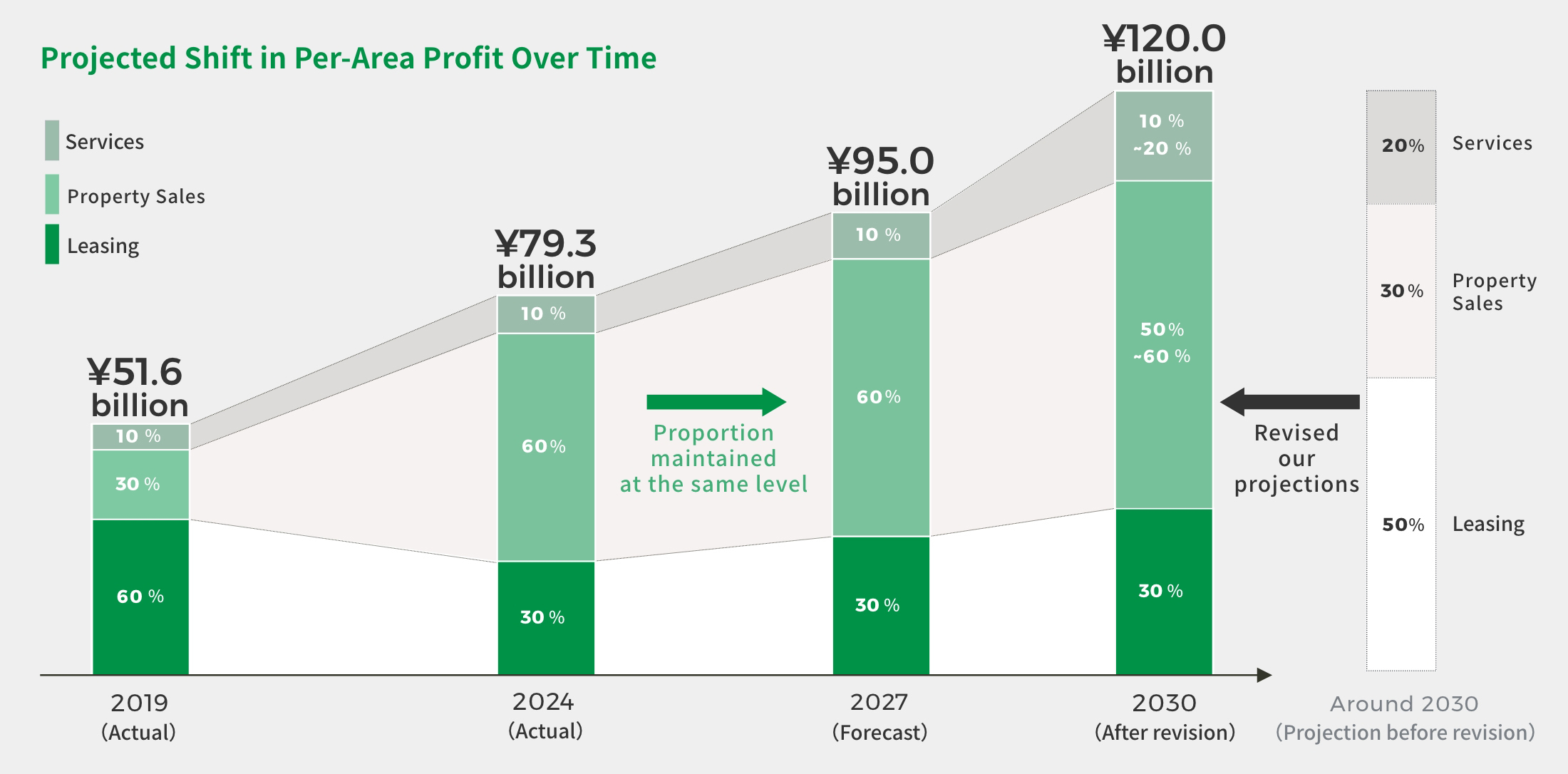

Steady Profit Growth

Target for 2030:

Business profit* of: ¥120.0 billion

Helping Solve a Variety of Social Issues

Contributing to the SDGs

Basic Profit Growth Policy

Based on stable rental profits,

aim for a well-balanced profit structure with an awareness of capital efficiency

Before change: Business profit = Operating profit + Share of profit (loss) of entities accounted for using equity method

After change: Business profit = Operating profit + Share of profit (loss) of entities accounted for using equity method, etc. * + Gain (loss) on sale of non-current assets

* Share of profit (loss) of entities accounted for using equity method, etc. includes interest and dividend incomes, and loss (gain) on sale of investment equity in investment vehicles for overseas businesses.

Basic Policy of the Medium-Term Business Plan

Quantitative Target

Accelerate and expand asset-turnover businesses based on the business portfolio strategy, and implement disciplined control of balance sheet, thereby achieving steady profit growth, greater capital efficiency, and increased shareholder returns.

Profit indicator

Business profit*1(FY2027)

¥95.0billion

Capital efficiency indicator

ROE

(current medium-term-plan period)

10%

Shareholder return policy

Payout ratio(FY2027)

40%

We will flexibly repurchase company shares, comprehensively taking into account the stock price level , business environment and financial situation, among other factors.

Before change: Business profit = Operating profit + Share of profit (loss) of entities accounted for using equity method

After change: Business profit = Operating profit + Share of profit (loss) of entities accounted for using equity method, etc. * + Gain (loss) on sale of non-current assets

*Share of profit (loss) of entities accounted for using equity method, etc. includes interest and dividend incomes, and loss (gain) on sale of investment equity in investment vehicles for overseas businesses.

Balance sheet control

|

Financial indicators

(FY2027) |

Debt-equity ratio*² approx. 2.4 x |

|---|---|

|

Interest-bearing debt / EBITDA*³ approx. 12 x |

|

Cross-shareholdings to net assets

(as of end of FY2027) |

10% or less |

|---|---|

|

Non-current asset sales / Cross-shareholdings sales

(cumulative over current medium-term-plan period) |

¥130.0 billion or more |

Interest-bearing debt ÷ Equity capita

Interest-bearing debt ÷ (Operating profit + Interest & dividend income + Share of profit (loss) of entities accounted for using equity method + Depreciation expense + Goodwill amortization expense)

Key Strategies in the Medium-Term Business Plan

Key strategies and classification of business portfolio management

| Key strategies | Action policies | Profit classification |

|---|---|---|

|

❶Steady promotion of |

Build up Build-up steady efforts to |

Leasing |

|

❷Further growth in the |

Accelerate Accelerate recovery of |

Property Sales |

|

❸Acceleration of the |

Property Sales |

|

|

❹Expansion of |

Scale Scale business operations |

Property Sales |

|

❺Expansion of |

Services |

|

|

❻Establishment of |

Establish Establish a new business |

Varied by |

Approach to the Business Portfolio Strategy

Shareholder Return Policy

- ■ Through sustained and stable profit growth, the payout ratio will be raised to 40% in FY2027.

- ■ We will flexibly repurchase company shares, comprehensively taking into account the stock price level, business environment and financial situation, among other factors.